Anyone Want to Buy Some Discretionary Items? Anyone?

Guidance cuts galore this week from some of the largest retailers

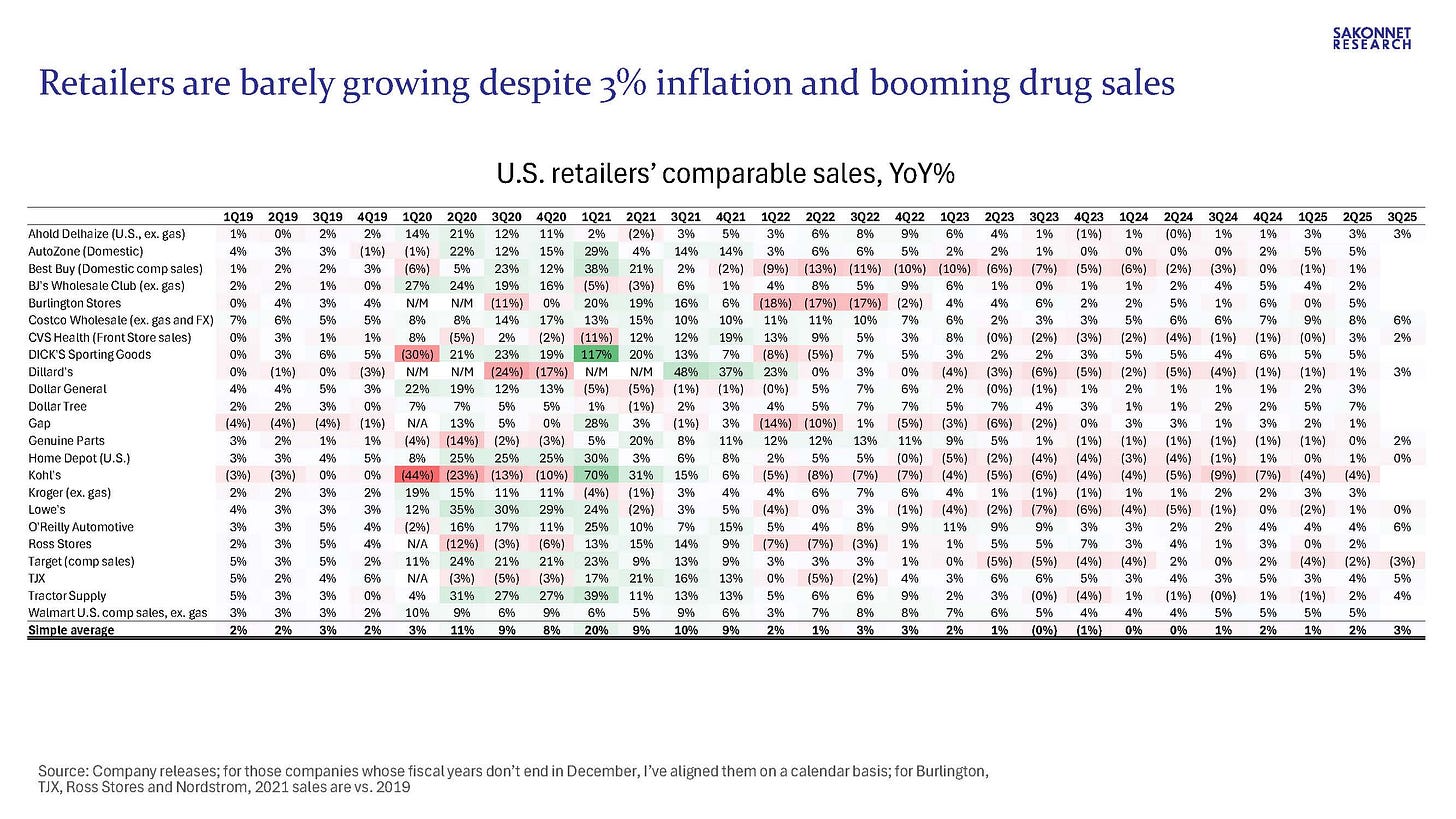

So far this week, three of the 10 largest U.S. retailers by sales have cut their full-year sales and/or profit guidance: Home Depot, Lowe’s and Target. Meanwhile, the 15th-largest retailer, TJX (operator of the discount retailers TJ Maxx, Marshalls and HomeGoods), raised its full-year guidance as Americans continue to trade down. Still to come this week are Williams-Sonoma (later this morning), Walmart (which has also benefited from trade-down behavior as well as booming drug sales), Ross Stores and BJ’s Wholesale Club.

Home Depot and Lowe’s are the same story, as they’re both tied to consumer spending on home repair and remodeling. Target is a different story, as it’s been dealing with weakness in discretionary spending as well as company-specific problems. Nonetheless, all cut guidance in 3Q as discretionary spending is under intensifying pressure owing to persistent inflation, labor market weakness and deteriorating population trends. Presumably TJX raised its guidance for some of the same reasons. U.S. real average weekly earnings are essentially unchanged from where they were in February 2020 (nearly six years ago), and the U.S. population is likely to have gone flat this year (the CBO projects up just 0.2%, down from a 1% average growth rate from 2022 to 2024) owing to all-time low birth rates and mass deportations. Consumer companies catering mainly to the rich continue to do well, but many others aren’t. As Richmond Fed President Tom Barkin said yesterday, “If you build data centers, or provide energy, or sell to higher-income customers, or trade on Wall Street, or build pharmaceutical plants, or live in the Carolinas, your economy is hot. But if you’re a farmer, or a realtor, or a manufacturer hurt by tariffs, or are dependent on lower-income consumers, you are struggling.”

The content in As the Consumer Turns newsletters should not be construed as investment advice offered by Adam Josephson. This market commentary is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. The views expressed in this commentary should not be taken as advice to buy, sell or hold any security. To the extent any content published as part of this commentary may be deemed to be investment advice, such information isn’t tailored to the investment needs of any particular person. No chart or graph provided should be used to determine which securities to buy or sell.