Financial System Leverage At Record Highs in Many Cases

Leverage is great for asset prices on the way up...

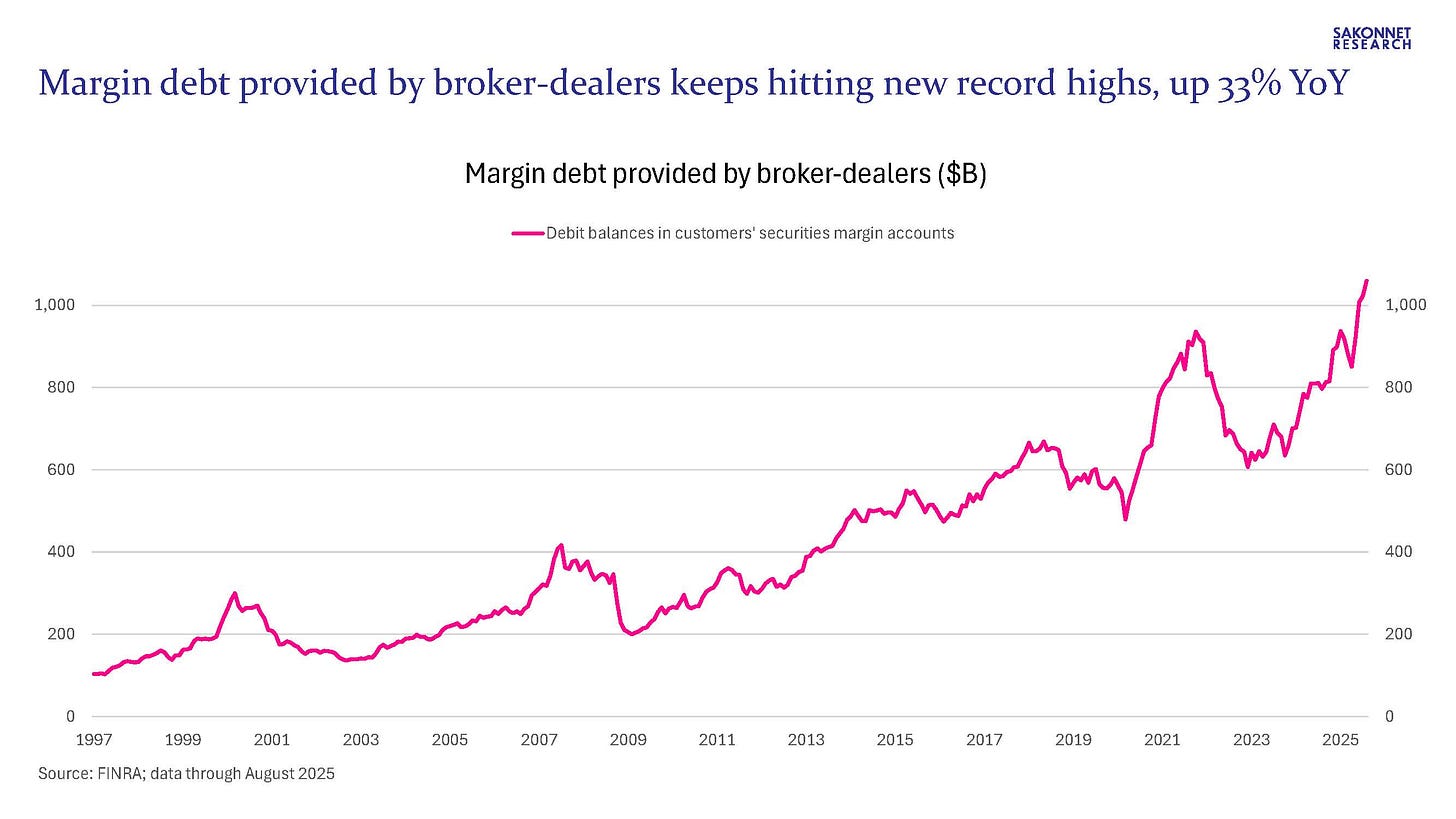

I published my last update on the numerous types of leverage/debt that have built up in the financial system (and inflated asset prices) a month ago (link); it’s time for another. Leverage keeps going up, up, and up, which continues to inflate asset prices. Margin debt provided by broker-dealers hit a new record high of $1.06 trillion in August, up an eye-watering 33% vs. a year ago. (This figure doesn’t capture reverse repo, margin loans from banks or other non-bank lenders, and margin-like products such as total return swaps.)

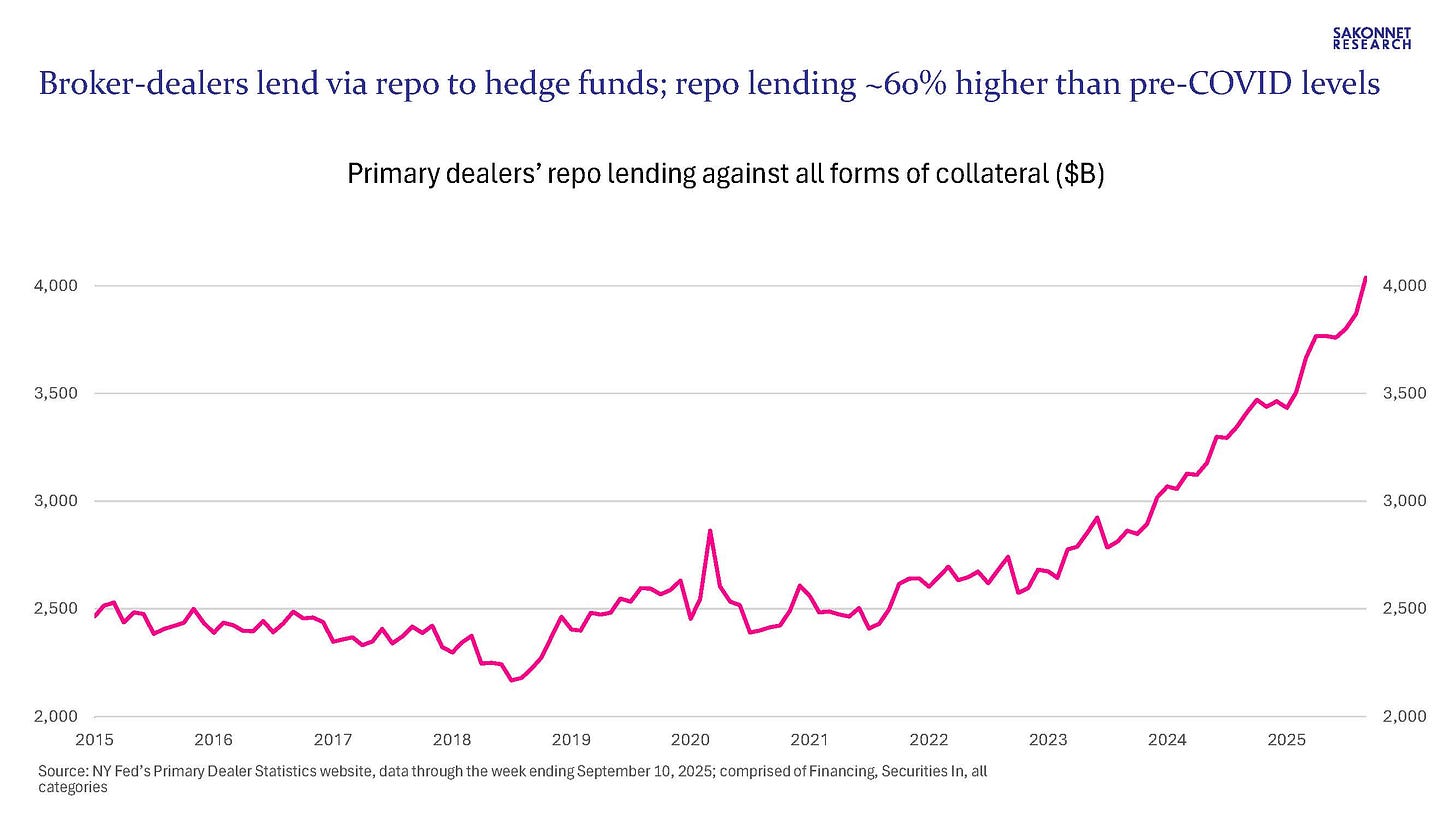

Not to be outdone, primary dealers’ repurchase agreement (repo) lending to hedge funds and others has broken above $4 trillion, continuing to hit new record highs each week.

And a substantial amount of this repo lending is being done with no “haircut” (link), meaning that hedge funds and other borrowers aren’t providing collateral in excess of the cash they’re borrowing. Lest one thinks this is normal practice, it isn’t. As the Bank for International Settlements (BIS) wrote in its 2025 Annual Economic Report, “Haircuts have gone to zero or even negative in large sections of the repo market, meaning that creditors have stopped imposing any meaningful restraint on hedge fund leverage. This higher leverage leaves the broader market more vulnerable to disruptions, as even slight increases in haircuts can trigger forced selling and amplify financial instability. Such adverse dynamics were on display, for example, during the market turmoil of March 2020, and contributed to the volatility spike in Treasury markets in early April 2025.”

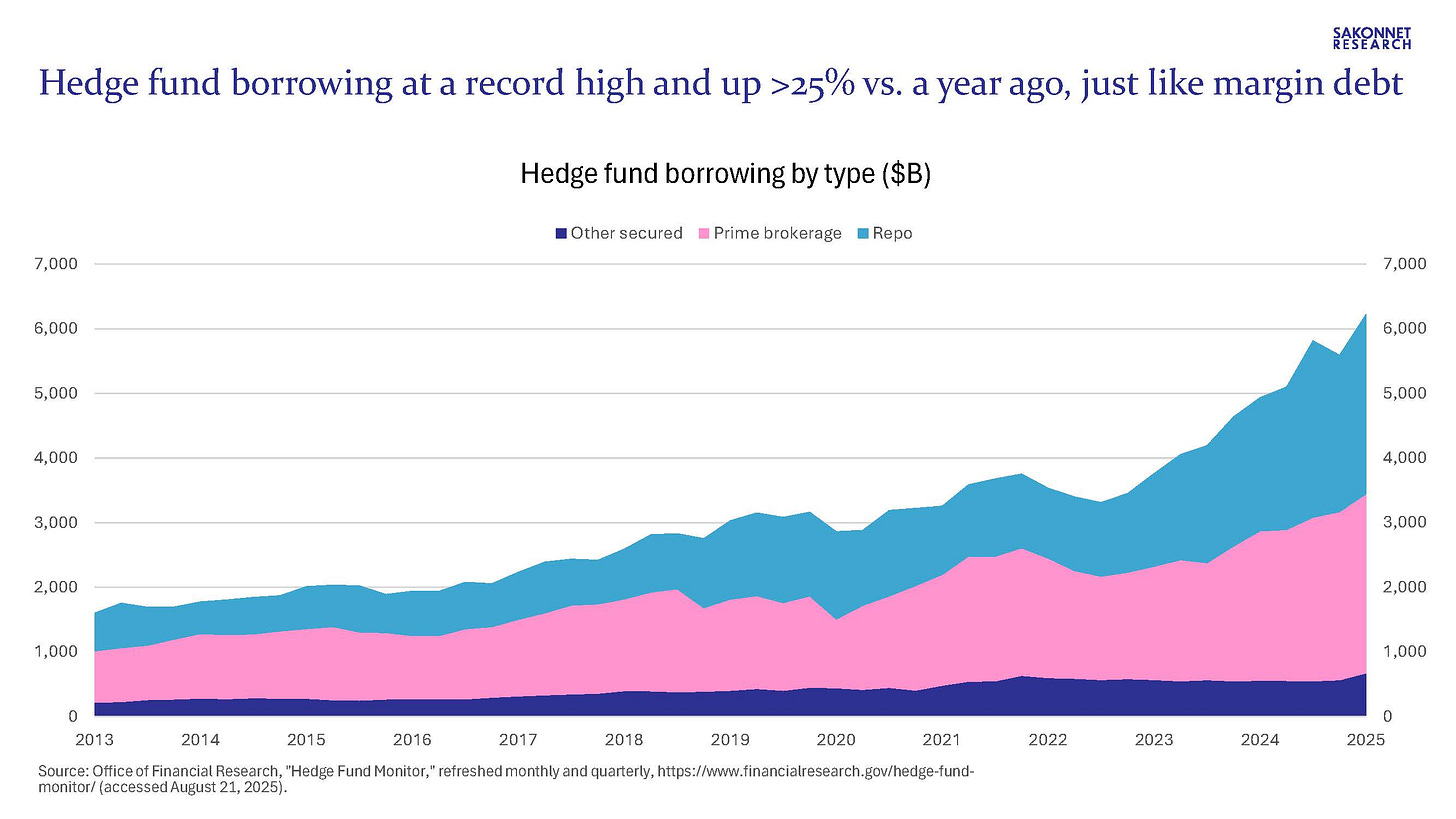

Speaking of hedge fund borrowing/leverage, it’s at a record high of $6.2 trillion, up more than 25% vs. a year ago at the end of March.

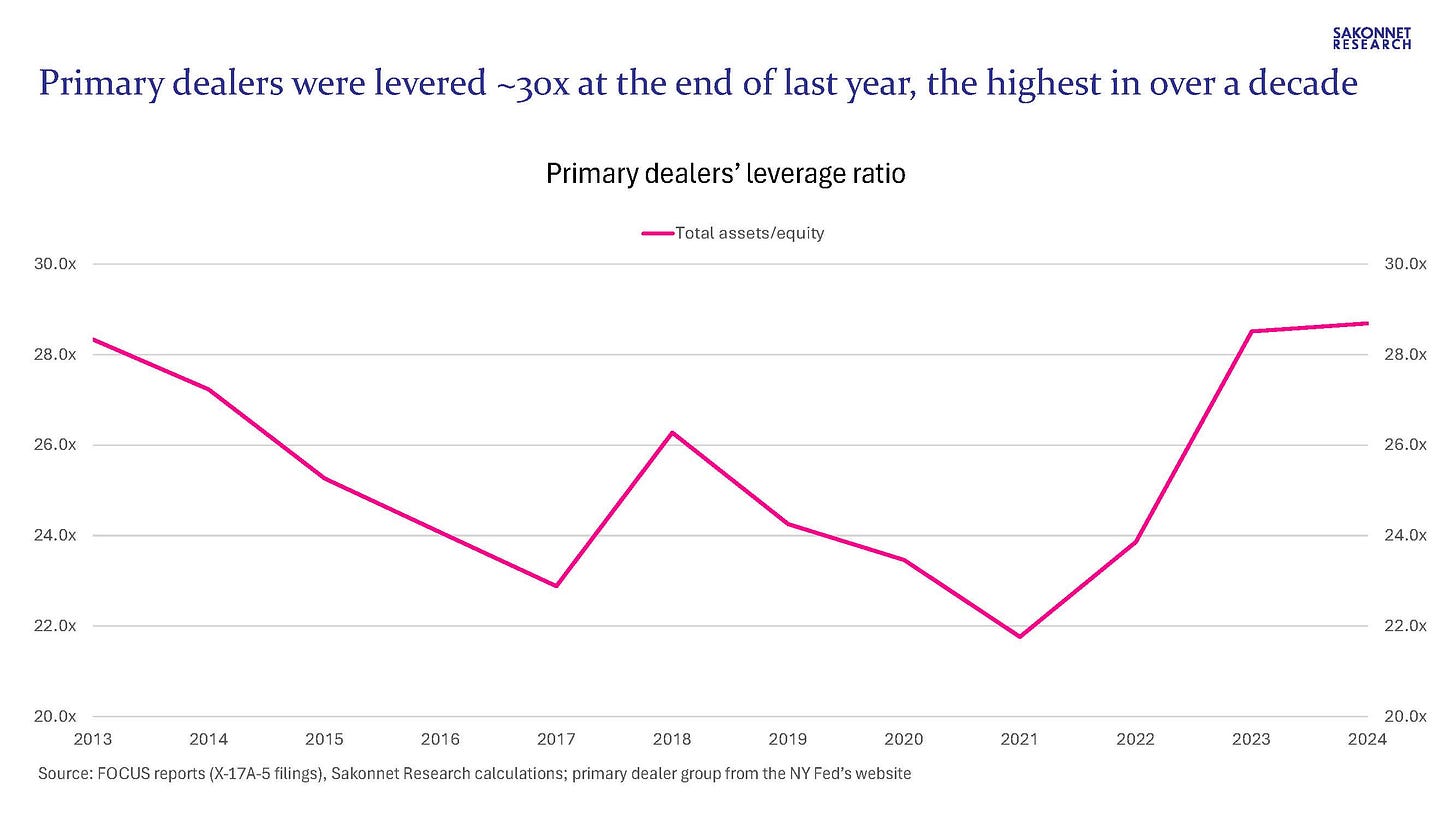

And as I’ve pointed out before, primary dealers themselves were levered around 30 times (assets/equity) at the end of last year, the highest level in over a decade.

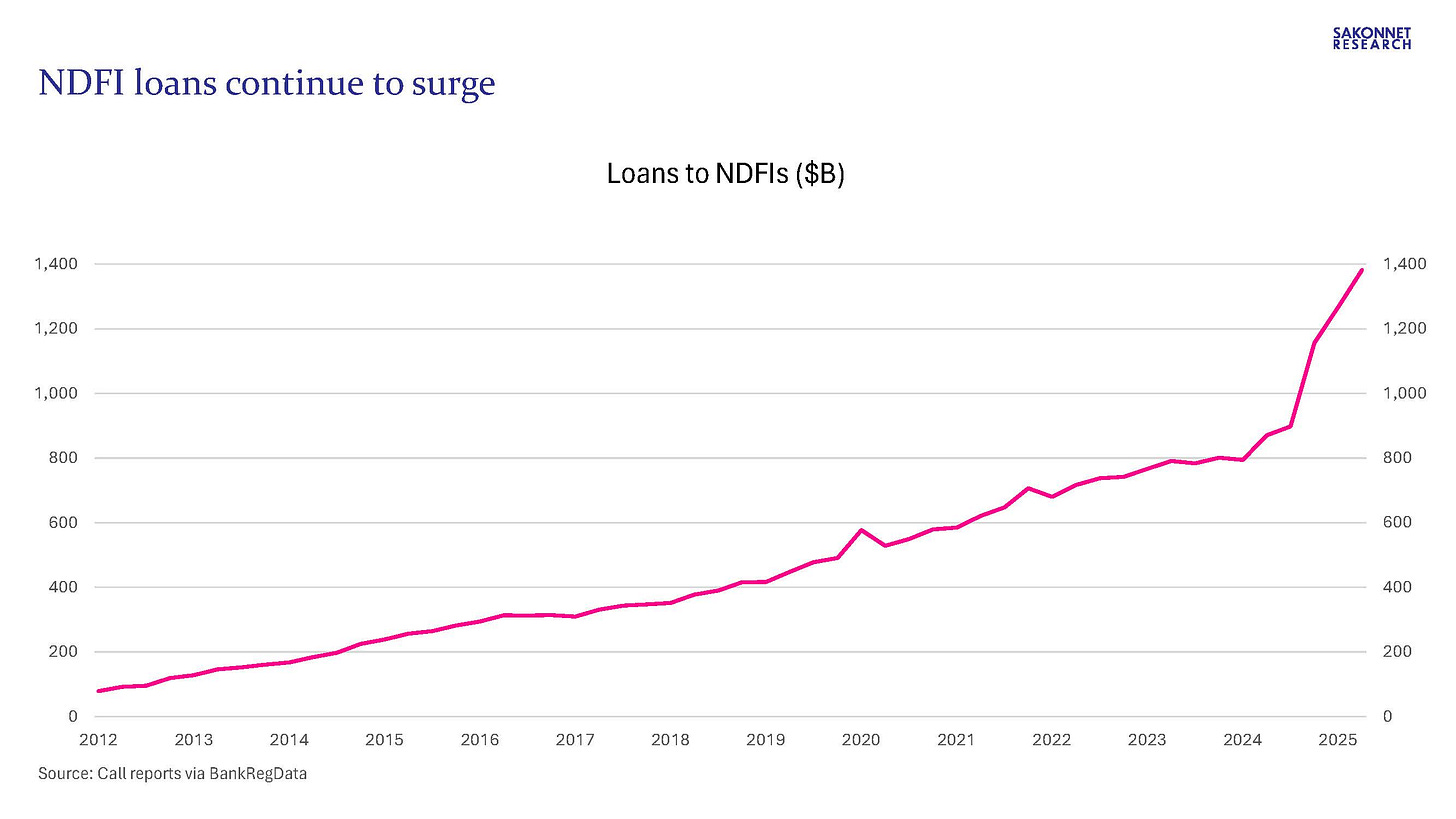

Part of the fuel for all the leverage being provided to broker-dealers and hedge funds? Bank lending to nondepository financial institutions (NDFIs) such as broker-dealers, hedge funds, private credit and equity funds, etc., which has ballooned in recent years and which accounts for nearly 11% of total loans compared to just 7% in 2Q24 (link).

Leverage is a very good thing for financial assets when it’s rising, as has been the case for the past three years. Leverage-fueled asset price booms, however, have a rather checkered history, as the BIS noted.