Home Depot's Results a Continuation of Recent Consumer Spending Trends

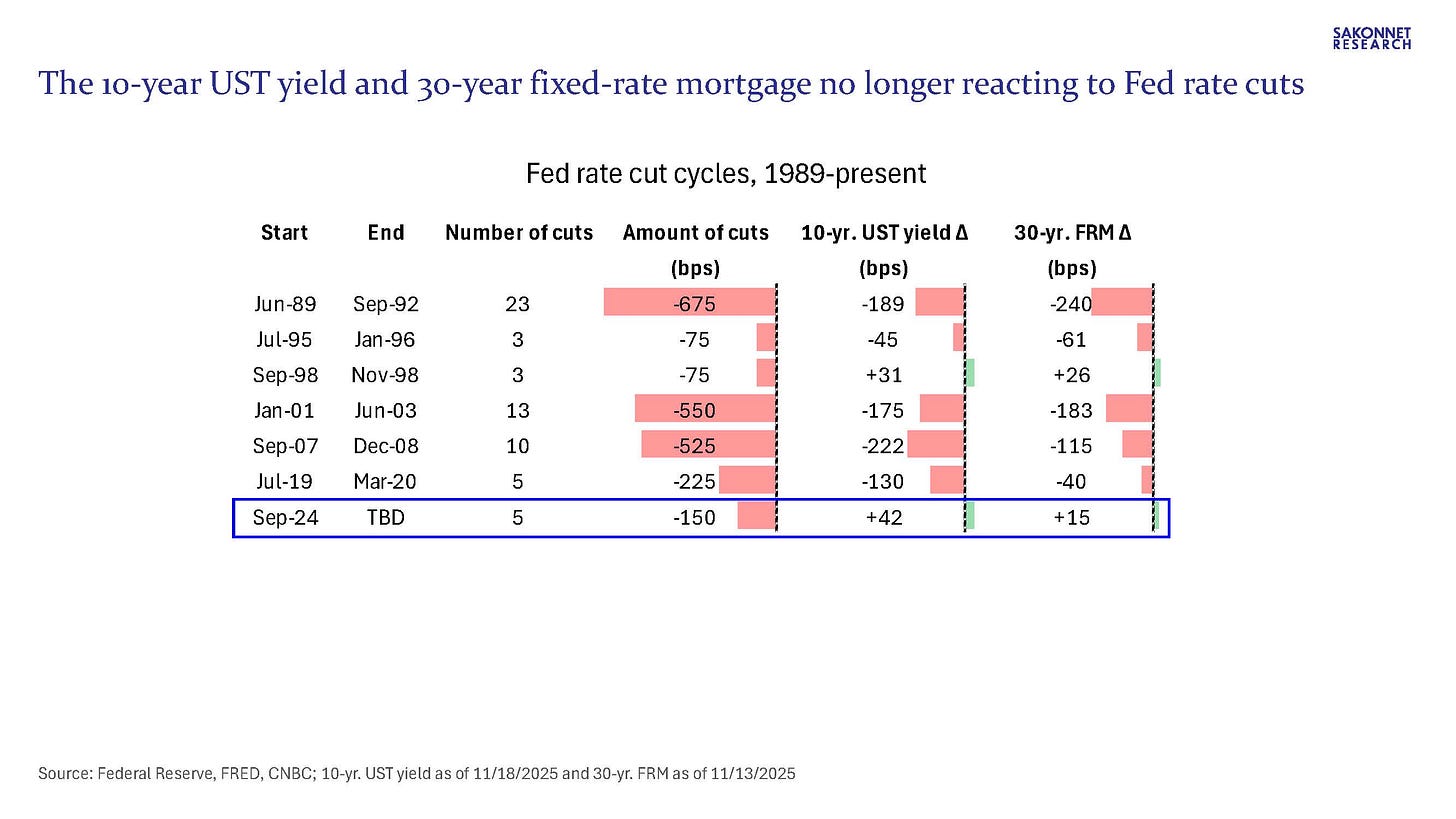

Highlights the ineffectiveness of the current Fed rate cutting cycle

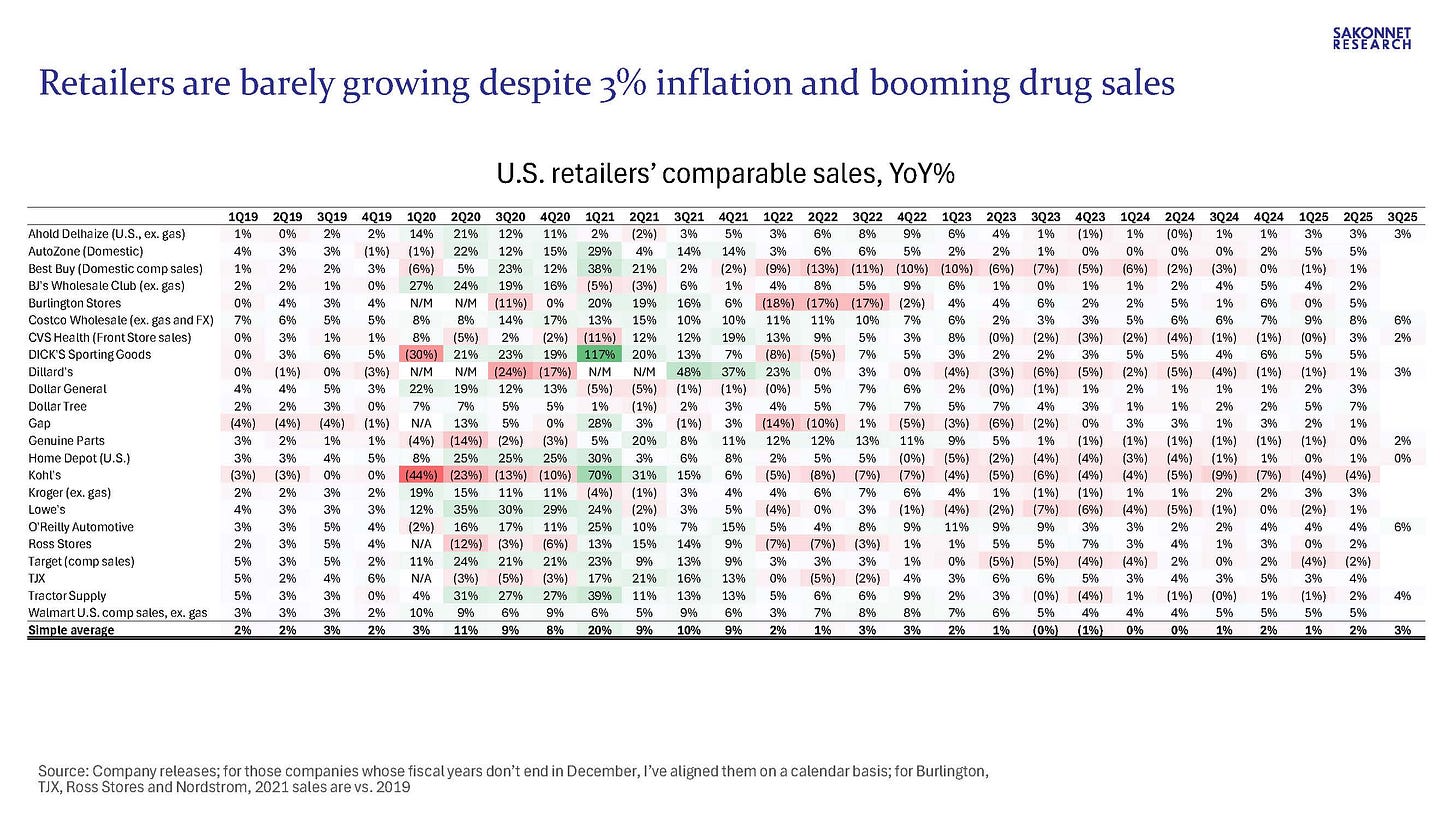

Home Depot, one of the five largest U.S. retailers, reported 3Q results below its expectations and cut its full-year guidance accordingly. The company expected sequential demand improvement in the second half of the year owing to lower interest and mortgage rates but instead has experienced “ongoing consumer uncertainty and continued pressure in housing disproportionately impacting home improvement demand.” As the company noted, housing turnover is at a 40-year low as a percentage of housing stock, and the trends aren’t improving.

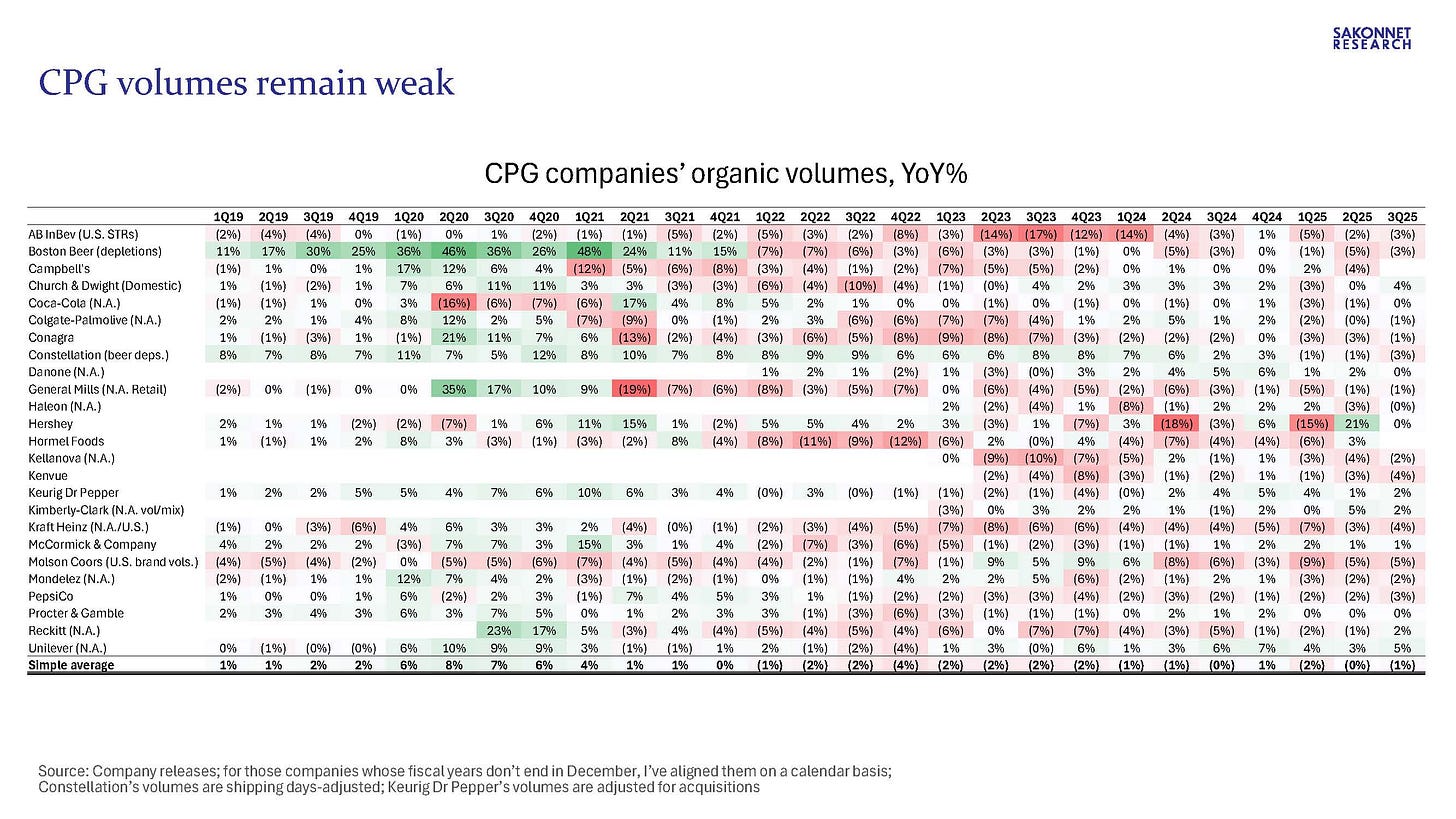

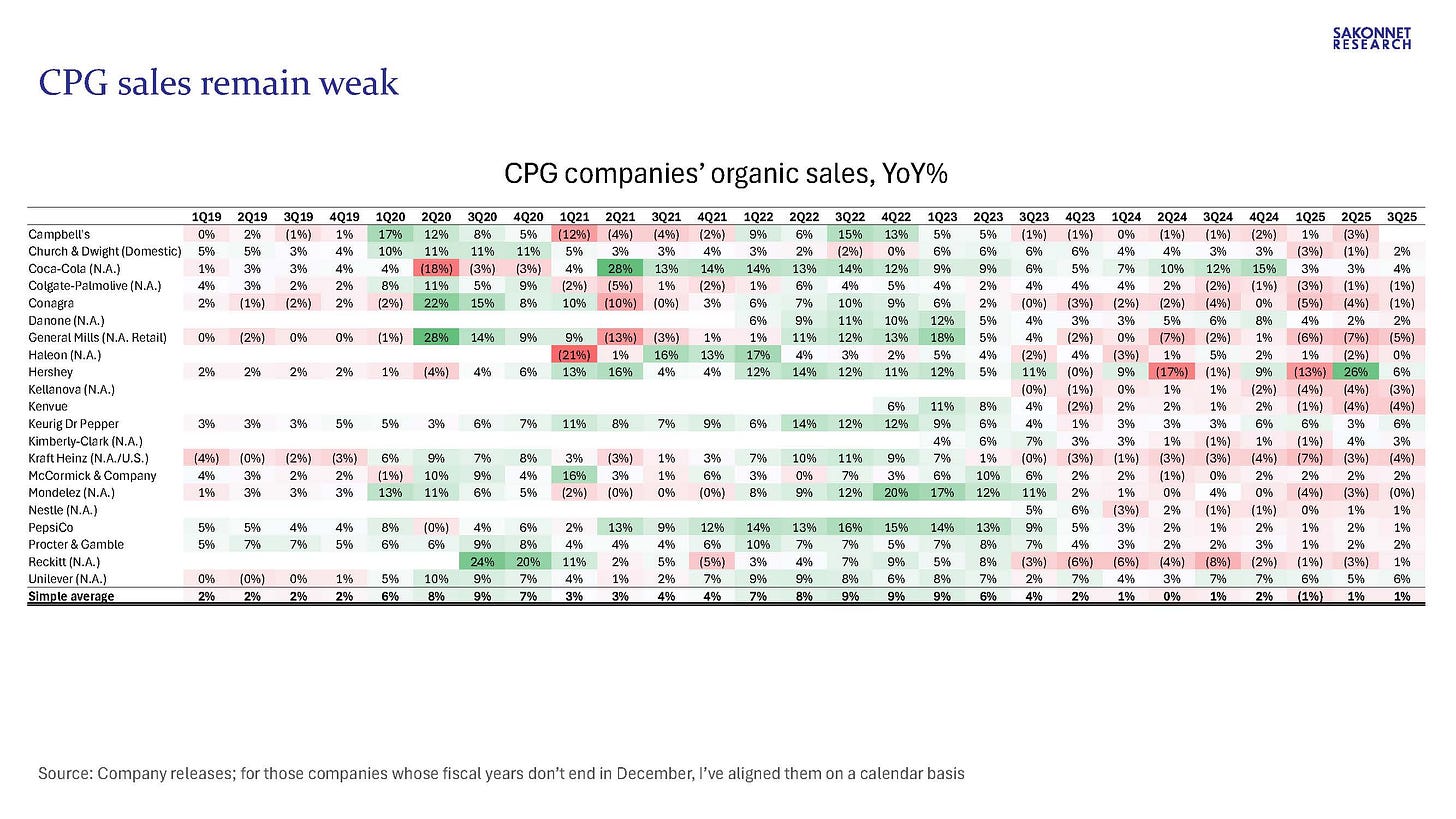

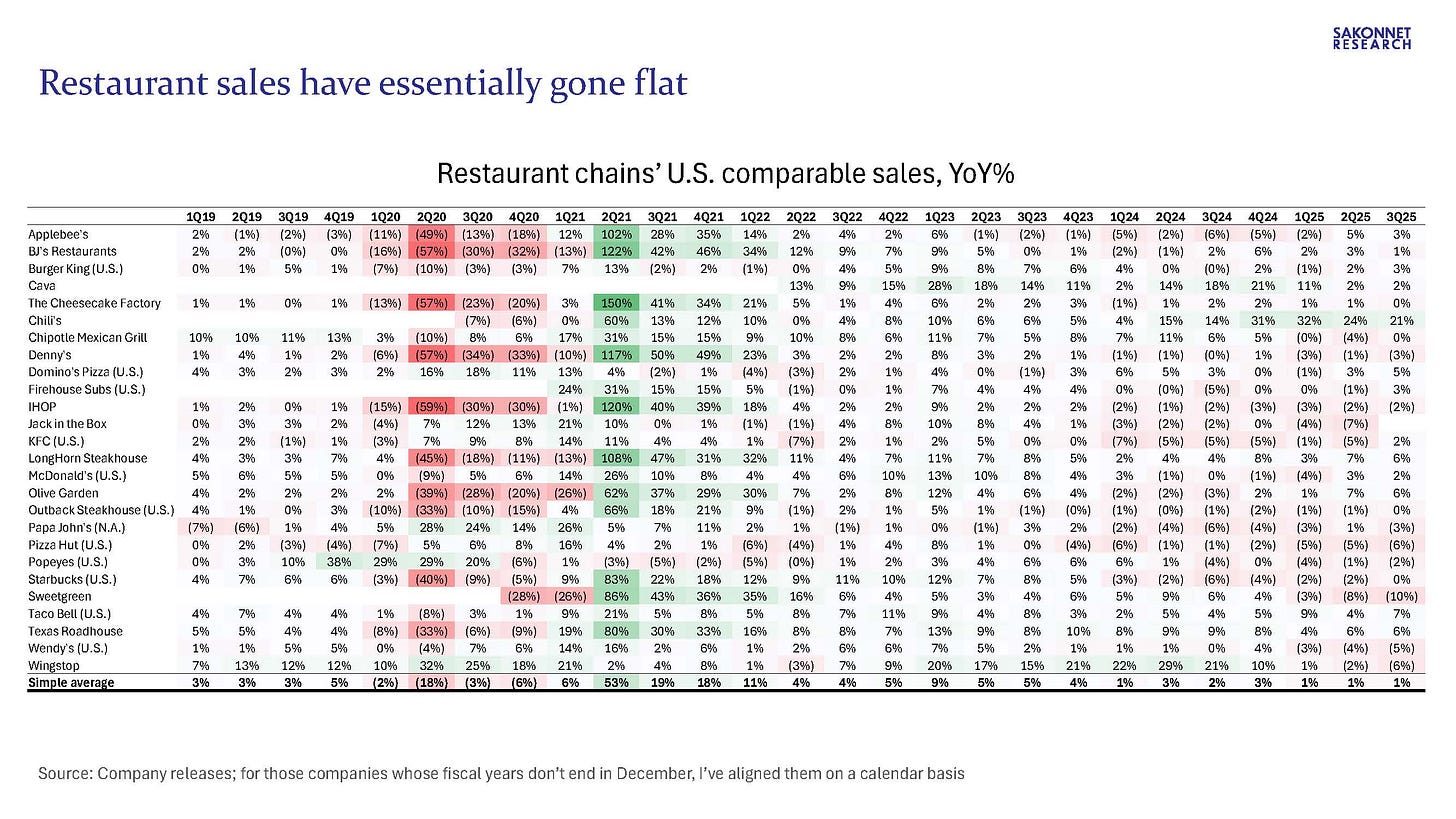

Home Depot’s results are a continuation of what we’ve seen from many other consumer companies this earnings season: those companies catering mainly to the rich are faring well but most others aren’t (link), as evidenced by an unusually large number of full-year sales/volume guidance reductions among consumer packaged goods (CPG) companies and restaurant chains (Constellation Brands, Mondelez, Colgate-Palmolive, Heineken, Kraft Heinz, Rémy Cointreau, Newell Brands, Chipotle Mexican Grill, Wingstop and Cava, among others). As Richmond Fed President Tom Barkin said this morning, “If you build data centers, or provide energy, or sell to higher-income customers, or trade on Wall Street, or build pharmaceutical plants, or live in the Carolinas, your economy is hot. But if you’re a farmer, or a realtor, or a manufacturer hurt by tariffs, or are dependent on lower-income consumers, you are struggling.”

Speaking of Home Depot’s expectation of lower interest and mortgage rates three months ago, that has indeed come to pass amid the Federal Reserve’s current rate cutting cycle (150 basis points of rate cuts since September 2024 and counting), but not enough to boost remodeling demand. Furthermore, this rate cutting cycle isn’t playing out as previous ones have: 10-year U.S. Treasury (UST) yields, and to a slightly lesser extent the 30-year fixed-rate mortgage, have moved in the opposite direction of the Fed’s target range for the federal funds rate since the Fed started cutting. UST yields moved in the same direction as the Fed’s target range in previous rate cutting cycles amid the 40-year “secular” decline in interest rates, but that decline appears to be over. To be fair, yields fell earlier last year in advance of the start of the Fed rate cutting cycle in September. Even so, yields are essentially unchanged from where they were in July 2024, 2-3 months before the rate cutting cycle began.

Why aren’t yields moving lower with Fed rate cuts? U.S. government deficits and debt are the highest they’ve ever been (except for the COVID period), and inflation has been above the Fed’s 2% target for nearly five years running. Consequently, long-term interest rates may no longer respond to the Fed’s rate cuts as they used to, which, if so, calls into question the efficacy of any further rate cuts.

The content in As the Consumer Turns newsletters should not be construed as investment advice offered by Adam Josephson. This market commentary is for informational purposes only and is not meant to constitute a recommendation of any particular investment, security, portfolio of securities, transaction or investment strategy. The views expressed in this commentary should not be taken as advice to buy, sell or hold any security. To the extent any content published as part of this commentary may be deemed to be investment advice, such information isn’t tailored to the investment needs of any particular person. No chart or graph provided should be used to determine which securities to buy or sell.