How Much Food Do You Sell, And To What Extent Do You Discount?

Examining the differences between Walmart's and Target's 3Q results

This week brought to the fore the diverging fortunes among U.S. retailers: Walmart raised its annual sales and profit guidance yet again and TJX (whose chains include TJ Maxx, Marshalls and HomeGoods) experienced continued healthy comparable sales growth, while Target cut its full-year profit guidance after having just raised it three months ago and Lowe’s experienced an eighth straight quarterly comparable sales decline. Why is this happening?

Walmart and TJX are discount retailers, and with the notable exception of the dollar store chains Dollar General and Dollar Tree, discount retailers are faring far better than other retailers this year as many Americans are trading down out of necessity. For those wondering why Walmart is growing at a much faster rate than is Target, a look at the composition of their merchandise sales is instructive. For Walmart U.S., 60% of its merchandise sales are grocery, compared to just 23% for Target. In this economic environment, the more essential items you sell, the better. Said Target’s CEO Brian Cornell per The Wall Street Journal, “Overall, we are still seeing a consumer shop very cautiously in discretionary categories, and we are planning accordingly.” Along those lines, Walmart noted continued market share gains across income cohorts led by upper-income households, and that households earning more than $100,000 accounted for 75% of those gains. I also pointed out yesterday that Walmart’s fastest-growing merchandise category by a wide margin isn’t even grocery but rather pharmacy (“Health & Wellness”), specifically prescription and over-the-counter drugs. Drugs are essential items just as is food, and those are the categories that are growing.

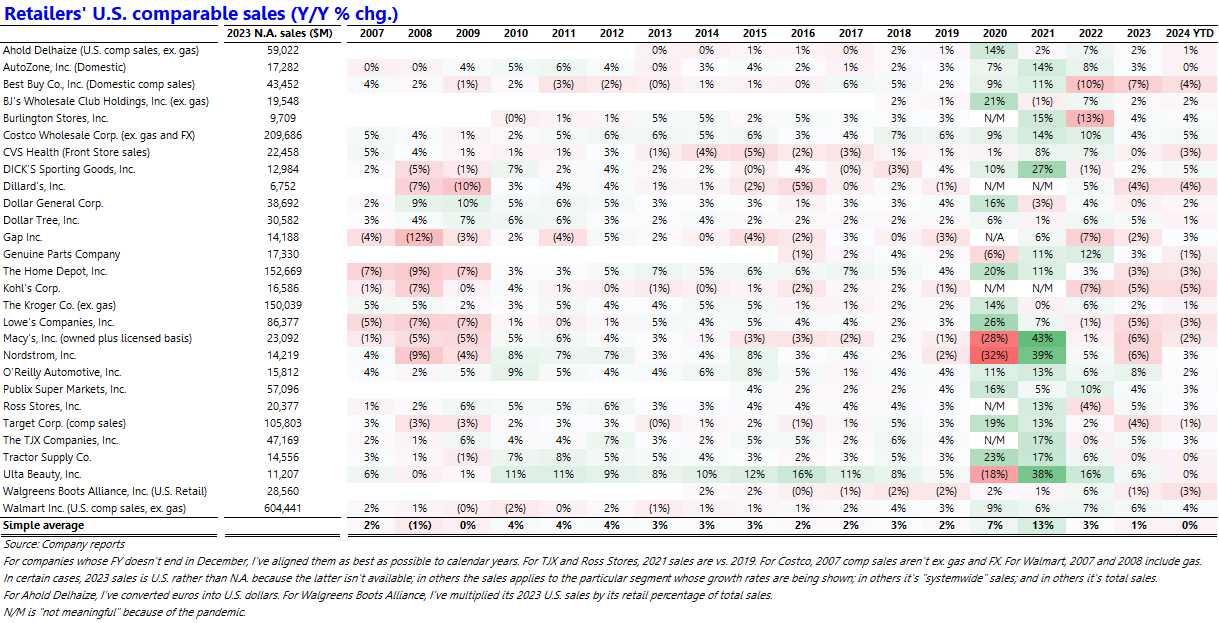

For those who think the U.S. consumer is in decent to good shape, they may want to consider which consumer they’re referring to; some are, while many others are not. Below is an updated table of retailers’ U.S. comparable sales trends; the recent slowdown to essentially no growth is apparent. In that context, the October retail sales growth of 2.8% YoY following 2% growth in September is a head-scratcher, at least to me. My retailer universe excludes e-commerce retailers such as Amazon and Wayfair, but it includes the e-commerce growth from the retailers listed, and e-commerce sales as a whole only contributed ~1 point to retail sales growth in 3Q (e-commerce accounted for 16.2% of retail sales, and it grew by 7.4% YoY).