NDFI Loans Are Far Larger Than We Thought

No wonder asset prices are booming as they are, and that the real economy is doing the opposite

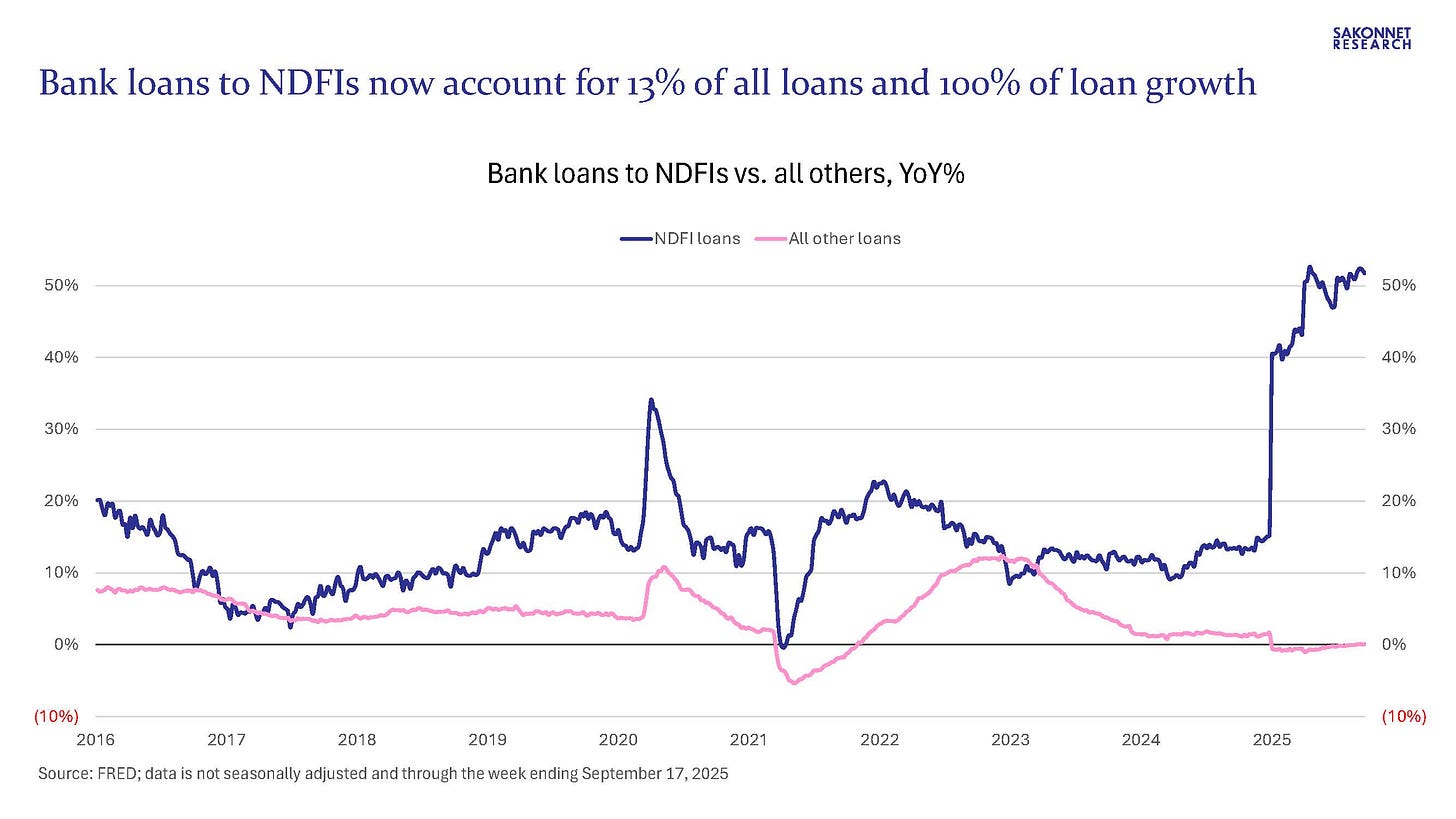

I’ve written extensively about mushrooming bank lending to nondepository financial institutions (NDFIs) such as broker-dealers, hedge funds, private equity and credit funds, securitization vehicles and subprime auto lenders. Such lending to the financial sector has helped fuel record-high leverage among hedge funds, decade-high leverage among primary dealers, record-high and rising margin debt, and record-high and rising repurchase agreement (repo) lending to hedge funds and others, which in turn has helped fuel record-high asset prices in many cases (link).

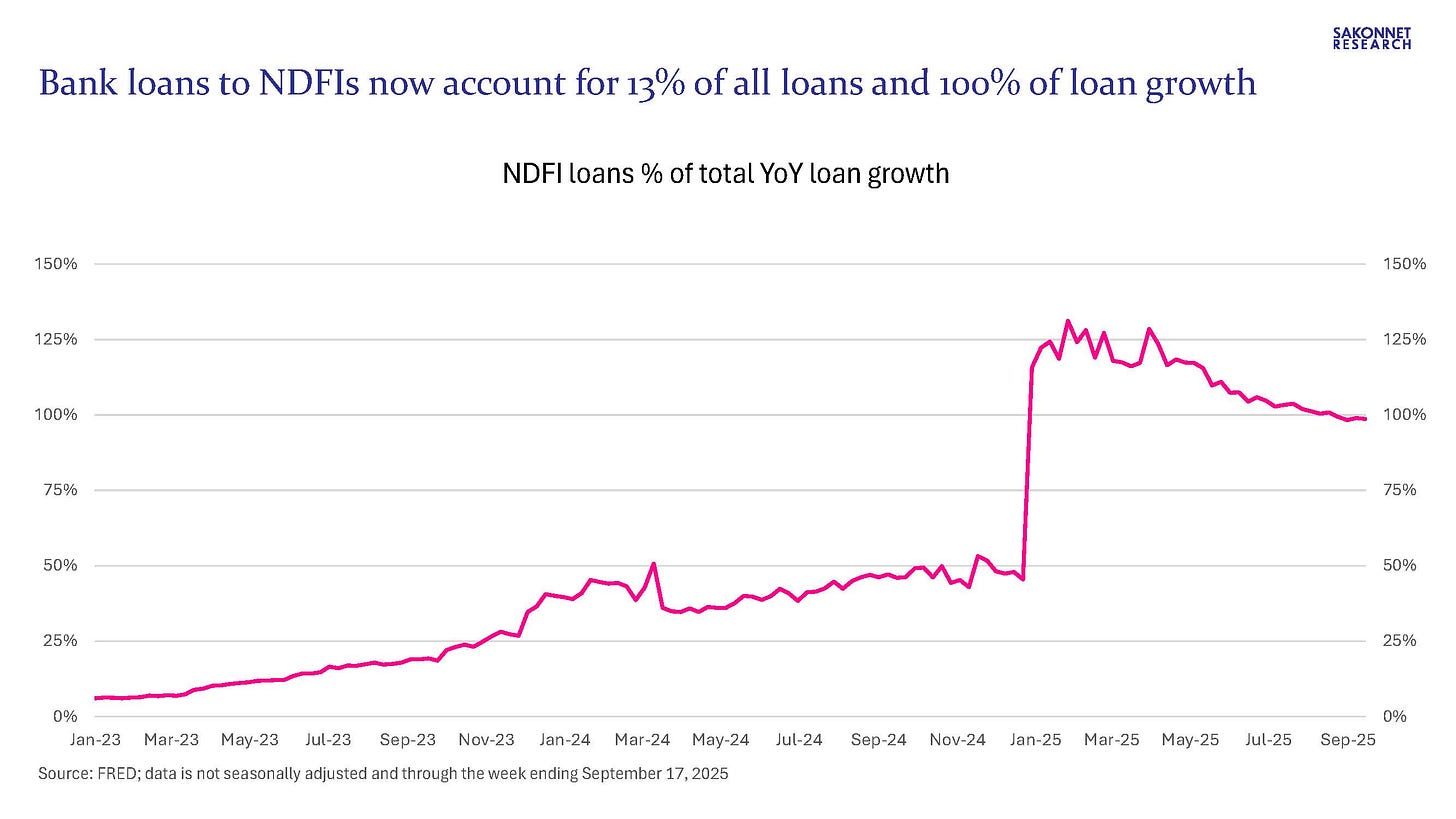

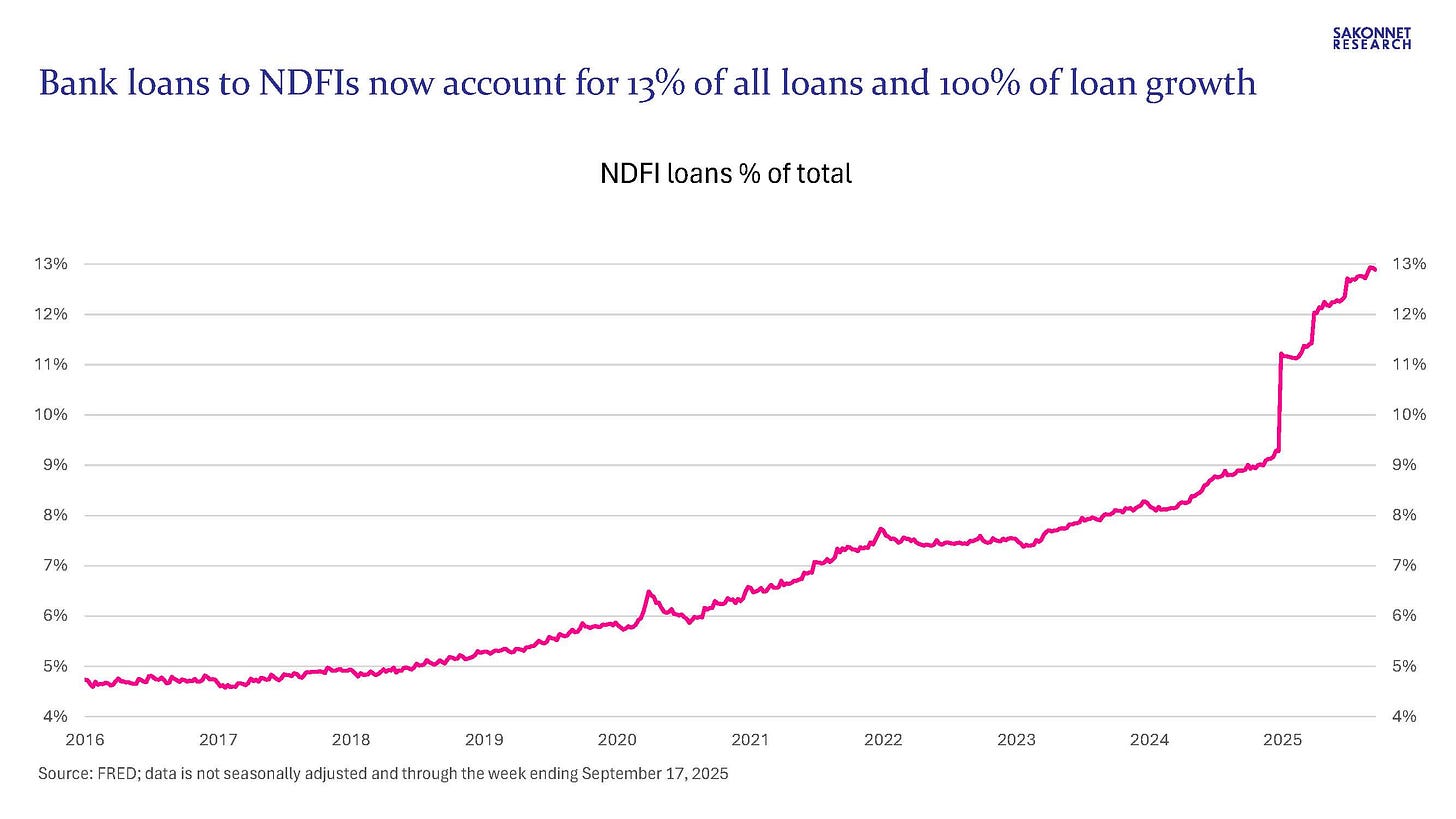

We already knew NDFI lending was booming: it had grown from $300 billion in 2016 to $1.4 trillion as of June 30, 2025 per call report data, accounting for nearly 11% of total loans. But it’s even bigger than that. Much bigger. In yesterday’s H.8 release (Assets and Liabilities of Commercial Banks in the United States), the Federal Reserve made substantial revisions to historical loan data, resulting in ~$340 billion higher NDFI loans and equivalent lower loans in other categories (including ~$170 billion lower commercial and industrial (C&I) loans and ~$150 billion lower consumer loans). As a result, bank lending other than to NDFIs has in fact declined this year (by 0.4%), and NDFI loans now account for 13% of all loans and are nearly two-thirds the size of C&I loans.

It’s no wonder, then, why the asset/financial economy is booming and the real economy is doing much the opposite, the latter evident by numerous recent sales guidance reductions among all manner of consumer-related companies (packaged food and beverage companies, homebuilders, other housing-related companies, adhesive manufacturers, the list goes on); I wrote about this issue last week (link). As I also wrote in that post, Fed rate cuts are unlikely to help matters; the 10-year U.S. Treasury yield is effectively unchanged from before the Fed started cutting rates last September, by a cumulative 125 basis points.

It’s also no surprise that some loans are starting to go bad, in some cases very bad: see Tricolor and First Brands (link). Apparently lax lending standards and a deteriorating economy are a suboptimal combination.