The Latest on Real Earnings and Consumer Companies

Real earnings are growing but consumer companies nonetheless keep cutting sales/profit guidance

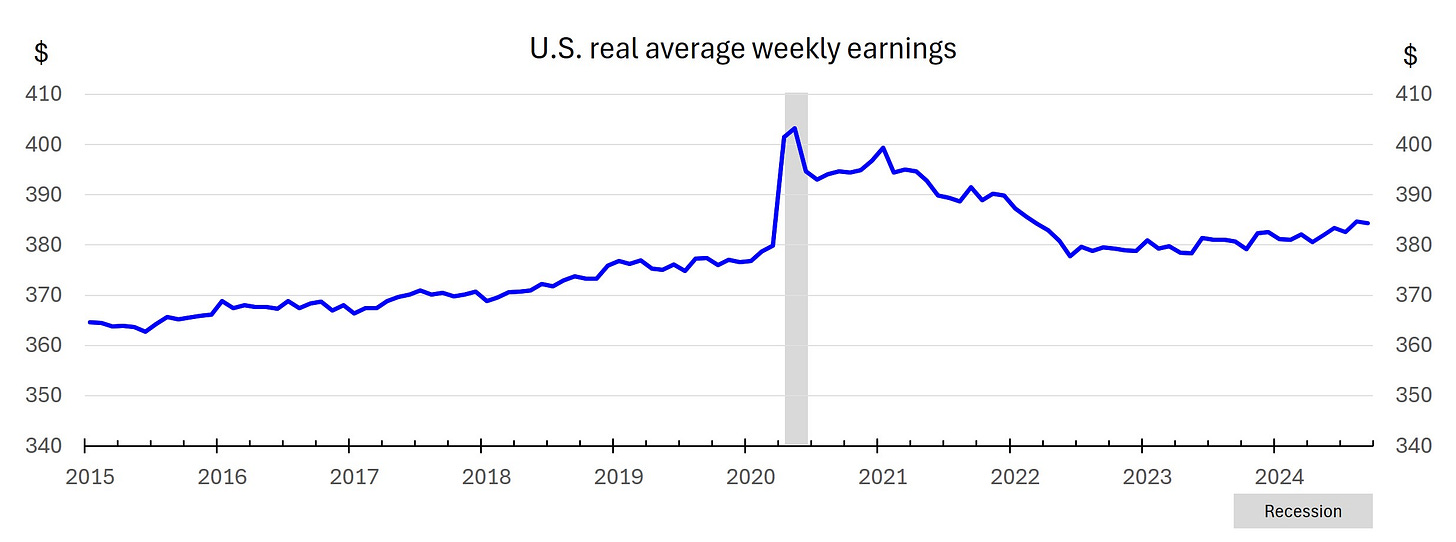

The Bureau of Labor Statistics released real (inflation-adjusted) earnings data for September this morning. I focus on real average weekly earnings because they incorporate changes in the average workweek, which has been in a steady decline over the past three years and is at its lowest level of the year (at 34.2 hours). Real average weekly earnings were up 0.9% year-over-year in September, but are up just 1.5% since February 2020 (right before the pandemic) and have increased by just ~5% in almost ten years, since the beginning of 2015.

Is the recent modest growth in real earnings helping consumer companies? Apparently not. I wrote two days ago about the unusually large number of consumer-related companies to have cut their full-year sales/profit guidance in the last three months, and the list grows as each day passes. Just today, Domino’s Pizza reduced its 2024-2025 global retail sales growth guidance from its previous 2024-2028 guidance of 7%+ to ~6%, and 7-Eleven’s parent company Seven & i Holdings cut its profit forecast for the fiscal year ending February 2025, citing a “more prudent approach to consumption” in North America, particularly among middle- and low-income earners. Seven & i noted a “persistently inflationary, elevated interest rate and deteriorating employment environment,” which runs counter to the notion of a robust economy characterized by above-trend GDP growth and (at least through 2024q2) accelerating corporate profit growth. Seven & i characterized the North American economy as “robust overall” thanks to the consumption of high-income earners, but clearly insufficiently so to prevent its guidance reduction.

Tomorrow will bring the start of big bank earnings, from which we’ll learn more about loan and core deposit trends and credit quality (which I’ve discussed in previous posts). I don’t think the trends along any of those lines will be positive.