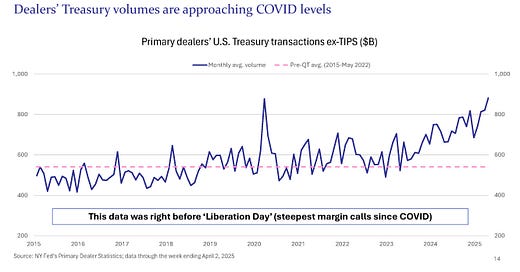

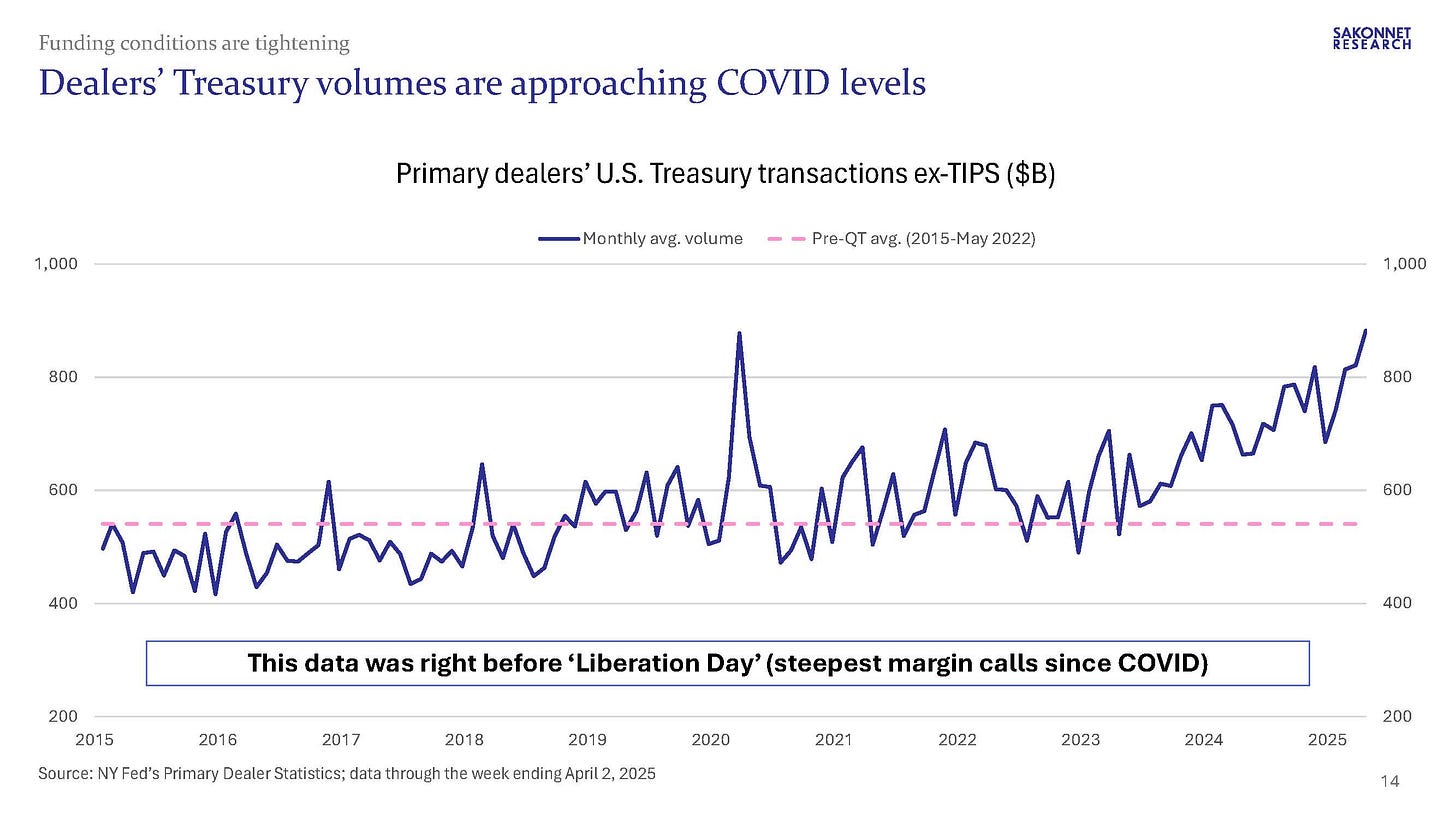

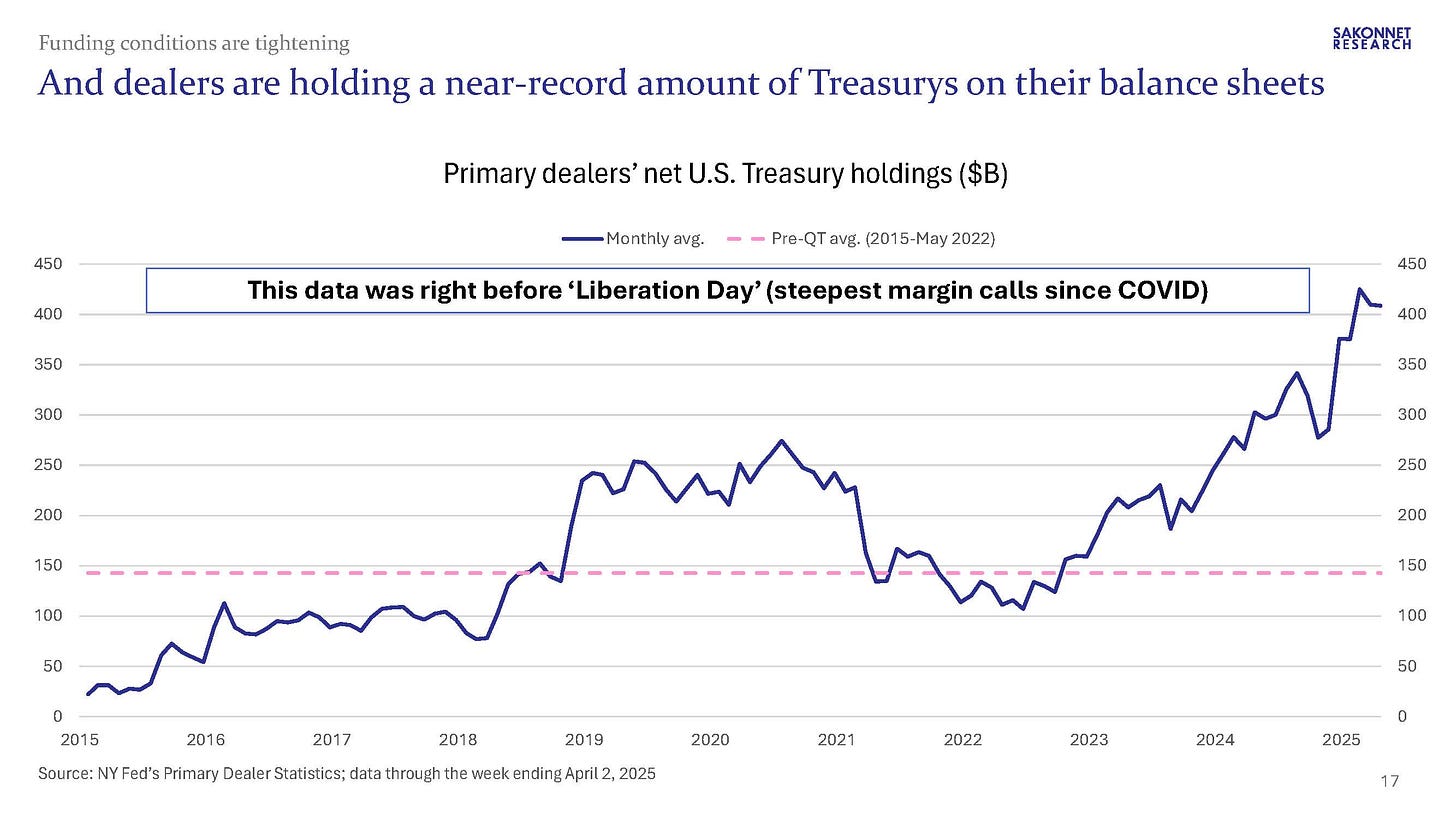

Following the presentation I published earlier this week that focused on funding conditions, I’ll provide weekly updates on funding markets. The Federal Reserve publishes its H.4.1 (Fed balance sheet) and the New York Fed publishes primary dealer data after market close on Thursdays, and the Fed publishes its H.8 (bank balance sheet) on Fridays after market close. Given the ongoing turmoil in asset markets, I expect there to be plenty to write about. In my presentation, I noted that primary dealers are holding a near-record amount of U.S. Treasury securities, and that remained the case as of the week ended Wednesday, April 2 (immediately before the ‘Liberation Day’ announcement): dealers held $409 billion of Treasurys, compared the record-high $455 billion at the end of February. Much the same applies to dealers’ transactions: their Treasury volumes averaged $882 billion, also close to a record. As dealers’ Treasury holdings continue to rise, so too do repurchase agreement (repo) volumes, which makes sense considering that dealers use repo borrowing to fund those holdings/volumes. Repo (borrowing) rates are increasing just as are repo volumes, which also makes sense. Next week’s primary dealer data will reflect the impact of ‘Liberation Day’, such that I assume volumes will rise yet further. Just like the primary dealer data, the bank balance sheet data is lagged by a week, such that there won’t be any ‘Liberation Day’ impact in tomorrow’s release.

In a reminder of why dealers’ balance sheets are constrained, the U.S. Treasury published its March statement earlier today: the government’s budget deficit is up to $1.31 trillion in the first six months of fiscal year 2025, up 15% vs. a year ago after accounting for calendar-year differences. The more money the government has to borrow, the more Treasury issuance dealers and others have to absorb.

Please see attached slide deck and a couple of charts below.