Monetary Policy "Normalization" Includes Ongoing Balance Sheet Reduction

Rate cuts and balance sheet shrinkage aren't mutually exclusive

I wrote yesterday about the relationship between the Federal Reserve’s (Fed) quantitative tightening (QT) program and banks’ core deposits: since the beginning of QT in June 2022, the Fed’s balance sheet has shrunk by $1.8 trillion while banks’ core deposits have fallen by $1.4 trillion (see below). So long as the Fed’s balance sheet continues to shrink, bank deposits are likely to continue to fall, and there’s a clear relationship between deposits and loans. (I previously discussed the relationship between the Fed’s balance sheet and bank deposits here.) Given ongoing QT and its likely effects, along with deteriorating credit quality and growing anecdotal evidence that some banks are capital-constrained, I believe banks’ loan growth will remain subdued for the foreseeable future, contrary to some expectations that falling interest rates will stimulate a significant upturn in borrowing and spending. I’ll expand on this issue in subsequent posts.

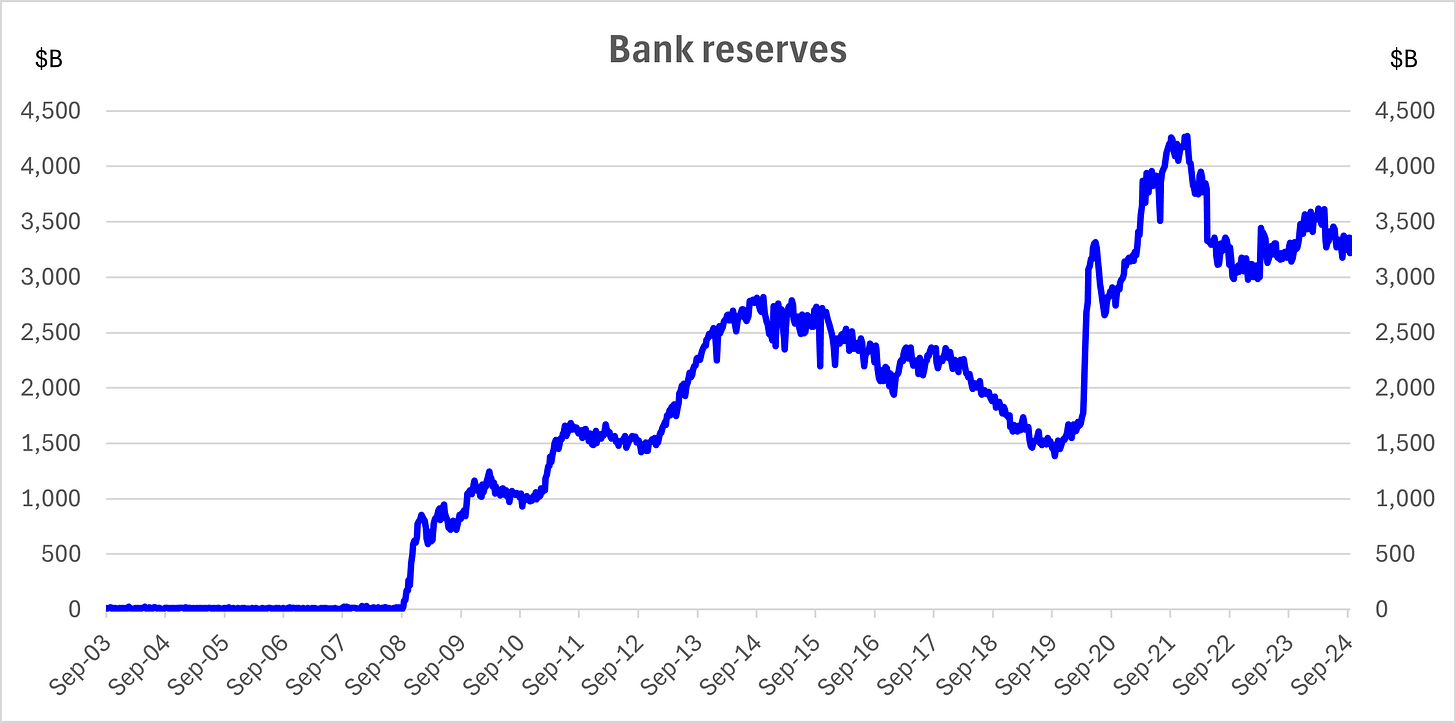

I bring up the issue of the Fed’s balance sheet because the person responsible for implementing monetary policy at the New York Fed gave a speech yesterday in which he indicated, among other things, that QT will continue for the foreseeable future. The official, Roberto Perli, said there’s no mechanical link between interest rate and balance sheet decisions, and that the ongoing balance sheet reduction and the cut in the federal funds rate last week are “perfectly compatible with each other.” He said the Federal Open Market Committee (FOMC) intends to stop balance sheet reduction/QT when reserves are “somewhat above the ample level…for now, we don’t appear to be close to that point.” I noted yesterday that bank reserves remain dramatically higher than they were pre-COVID even after more than two years of QT, because the entirety of the Fed’s balance sheet reduction thus far has come out of its overnight reverse repurchase facility (ON RRP). As Chair Powell said at his press conference last week, “reserves are still abundant and expected to remain so for some time.”