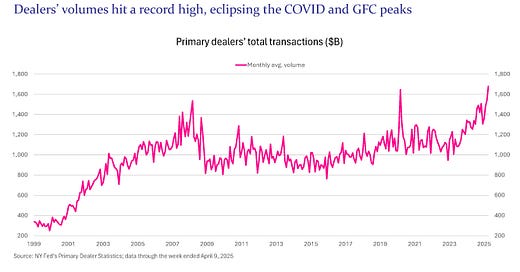

Primary Dealers' Volume Hits Record High, Eclipsing COVID and GFC Peaks

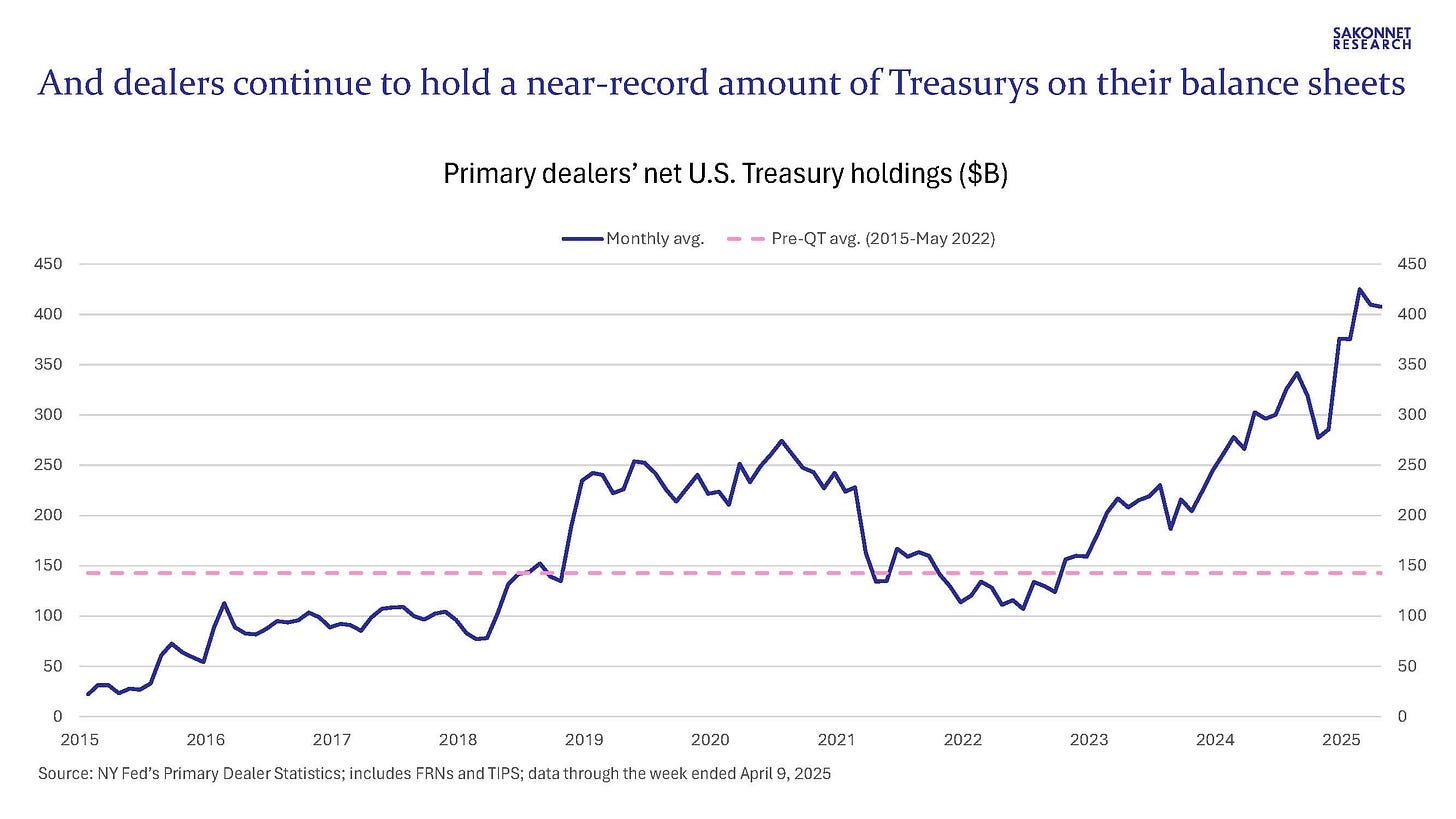

Treasury holdings also near a record; cue the discussion of potential SLR relief for banks

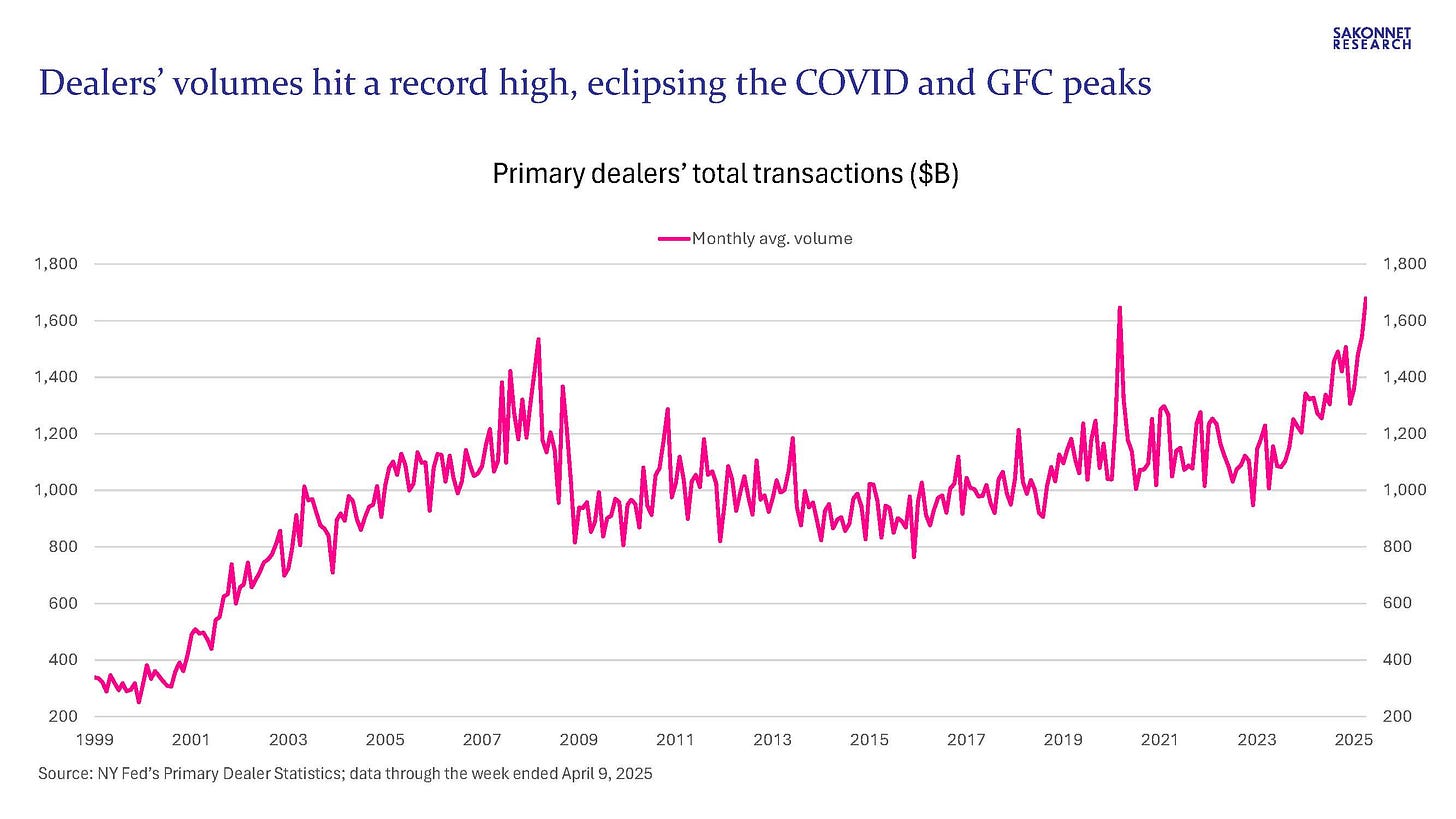

I wrote last week about primary dealers’ near-record amount of U.S. Treasury inventories/holdings and securities transactions, and assumed their transactions would rise yet further the following week (the week ended April 9) given the destabilizing impact of ‘Liberation Day.’ Indeed, transactions reached a record high per the just-released primary dealer statistics, eclipsing the COVID and Great Financial Crisis (GFC) peaks. Dealers transacted a daily average of $1.96 trillion that week, including $1.136 trillion of Treasurys (excluding TIPS); the COVID and GFC peaks were $1.81 trillion and $1.72 trillion, respectively. And their Treasury holdings, at $407 billion, remained near the record-high $455 billion reached at the end of February.

Dealers’ historically high transactions and Treasury holdings should come as little surprise considering the combination of the U.S. government’s record (excluding COVID) and fast-growing budget deficits, the Federal Reserve’s ongoing balance sheet reduction program (quantitative tightening, or QT), and declining foreign official ownership of Treasurys (down 5% over the past three years). I wrote last week that banks were being asked about a potential SLR (Supplementary Leverage Ratio) rule change that would enable them to hold more Treasurys; part of Jamie Dimon’s response on JPMorgan Chase’s 1Q call was that such a change would help the markets, not banks. David Solomon of Goldman Sachs called for a change to the SLR rule on Monday, saying that “SLR relief would have a benefit to Treasury markets. It’s an important structural reform.” And indeed, the Deputy Treasury Secretary said this week that U.S. officials were considering an SLR rule change. What’s clear is that he’s paying close attention to the recent weakness in the Treasury market; he noted the precise decline in the 10-year Treasury yield on Monday.