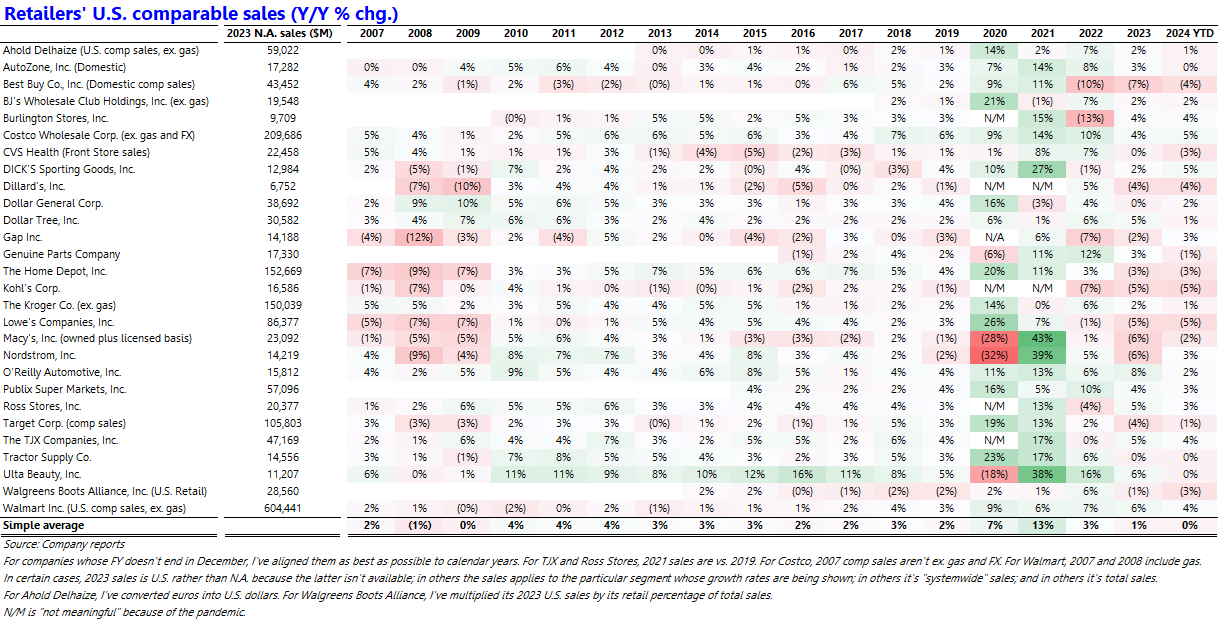

Retailers' Comparable Sales Have Gone Flat

The last time this happened was in 2009, for different reasons

I recently wrote about the disproportionate percentage of GDP growth coming from government spending and health care spending, neither of which accrues to the benefit of most consumer companies (other than retailers with a pharmacy business). I was puzzled by the disconnect between above-trend GDP growth and sales guidance reductions on the part of all manner of consumer companies, which prompted me to analyze the composition of GDP growth and led me to that finding. What the sales guidance reductions didn’t tell me was how consumer companies are performing compared to previous years. Given that retail earnings season is in full swing (and that October retail sales came out this morning), now’s a good time to take a look.

Large retailers’ comparable (also known as comp or same-store) sales trends are similar to 2009 in that there’s no growth, though the reasons and composition are different. Then was a global financial crisis that brought the economy to its knees; now it’s substantial cumulative price inflation that has crimped households’ budgets. Then, dollar store retailers such as Dollar General and Dollar Tree flourished; now they’ve been cutting their guidance and closing hundreds of stores owing to an increasingly “cash strapped consumer” (as Dollar General recently put it). Then, Walmart’s U.S. comp sales were flat; now they’re up 4% year-to-date, and Walmart is among the fastest-growing large retailers along with Costco, TJ Maxx, Ross Stores, and Burlington Stores, all discount retailers. What’s going on?

A recent quote from a retail analyst at Telsey Advisory Group resonated with me. “Walmart and Costco and TJ Maxx and Ross and Burlington have all performed very, very well because the consumers are shopping at them more frequently in an effort to save money,” he said. “They’re just not trading all the way down to the dollar stores.”

The obvious question is how/why this situation will change anytime soon. In other words, what will put more money in people’s pockets? Inflation remains above the Federal Reserve’s target, such that real average weekly earnings are little better than flat (up just 1.8%) from pre-pandemic levels (four and a half years ago). Household wealth is at a record high thanks to ever-rising stock and home prices, but that hasn’t helped many Americans: the top 1% of households held 27.4% of assets and the top 10% held 62% of assets as of 2024q2, compared to the bottom 50% with just 5.7% (link). And the government has been running historically large budget deficits, which have been stimulative to the economy. If historically stimulative fiscal policy and record household wealth aren’t helping many Americans, what will?

In the coming days I’ll publish comparable annual sales tables for the consumer packaged goods (CPG) companies and restaurant chains; the trends are similar to those that retailers are experiencing.