The Great Health Care Spending (and Jobs) Boom

A robust economy, at least for drugs and health care services

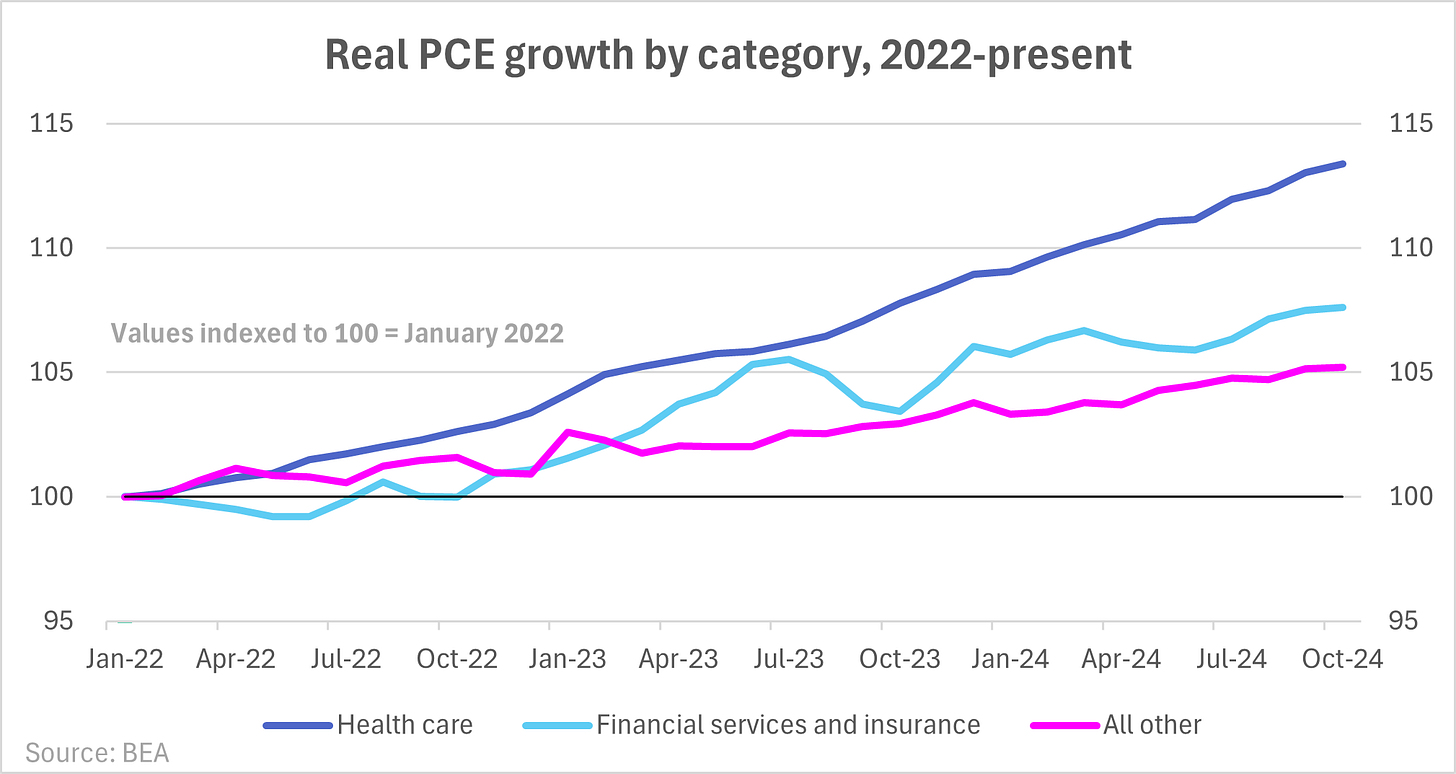

Post-COVID, a disproportionate percentage of U.S. consumer spending growth has come from health care and to a lesser extent financial services and insurance, most if not all of which are mandatory rather than discretionary categories; here’s my latest on the topic. Kroger, the largest U.S. supermarket chain, reported its 3Q results yesterday; its comparable sales growth was once again boosted by its pharmacy/drug business (“Kroger achieved strong sales results in the third quarter led by our pharmacy and digital performance…”). Since the beginning of 2022, inflation-adjusted consumer spending on categories other than health care and financial services and insurance is up just 5%; health care spending is up nearly 3x that amount. (Note: my definition of total health care spending comes from the BEA’s website.)

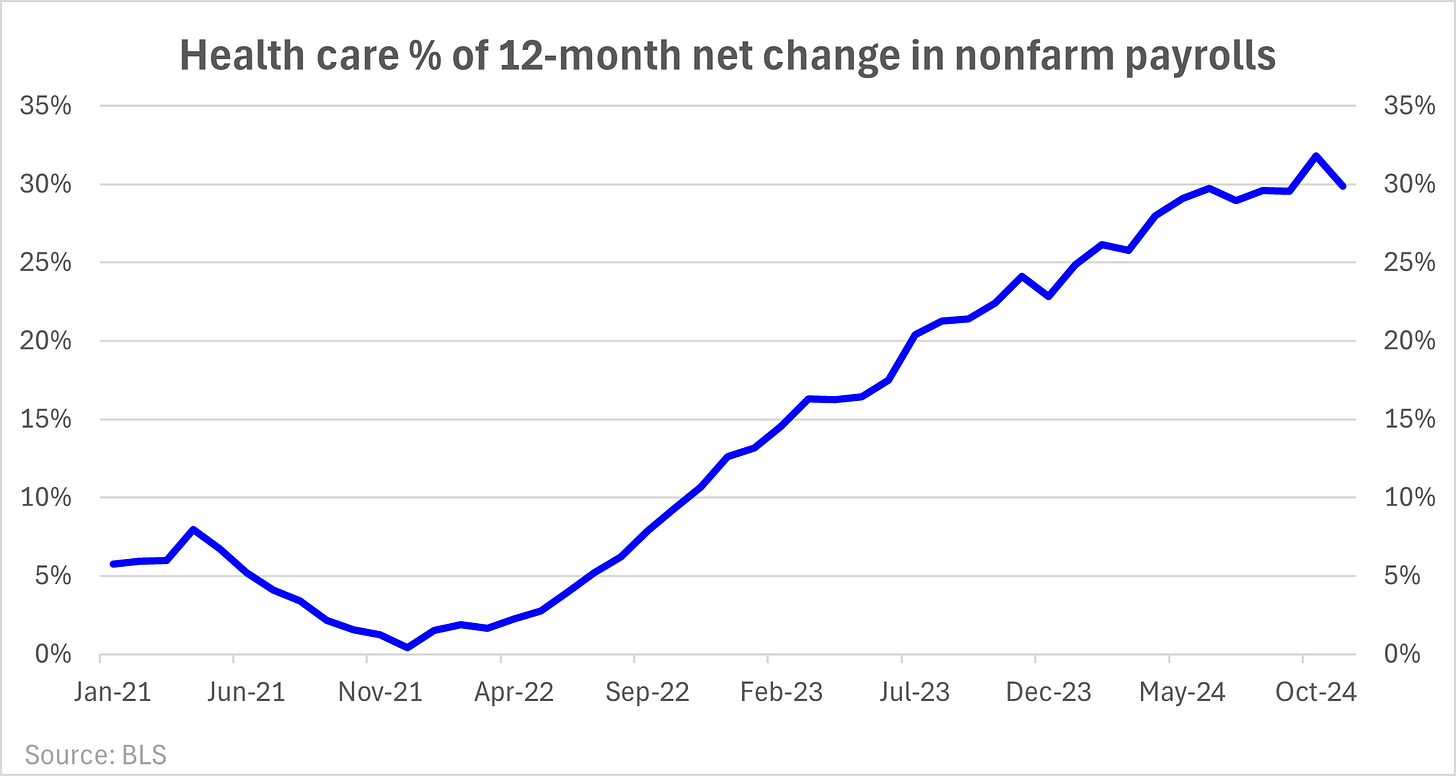

I wasn’t surprised, then, to read in the November nonfarm payrolls report this morning that “over the month, employment trended up in health care, leisure and hospitality, government, and social assistance.” In fact, health care accounted for 30% of the 12-month net change in nonfarm payrolls, well above its historical average; dating back to 2014 (excluding March 2020), the average contribution from health care has been 13%. We’re living in an increasingly health care-dominated (and government-dominated) economy.