Why Aren't Banks Lending More to Main Street?

Still-substantial unrealized losses on their securities holdings could have something to do with it

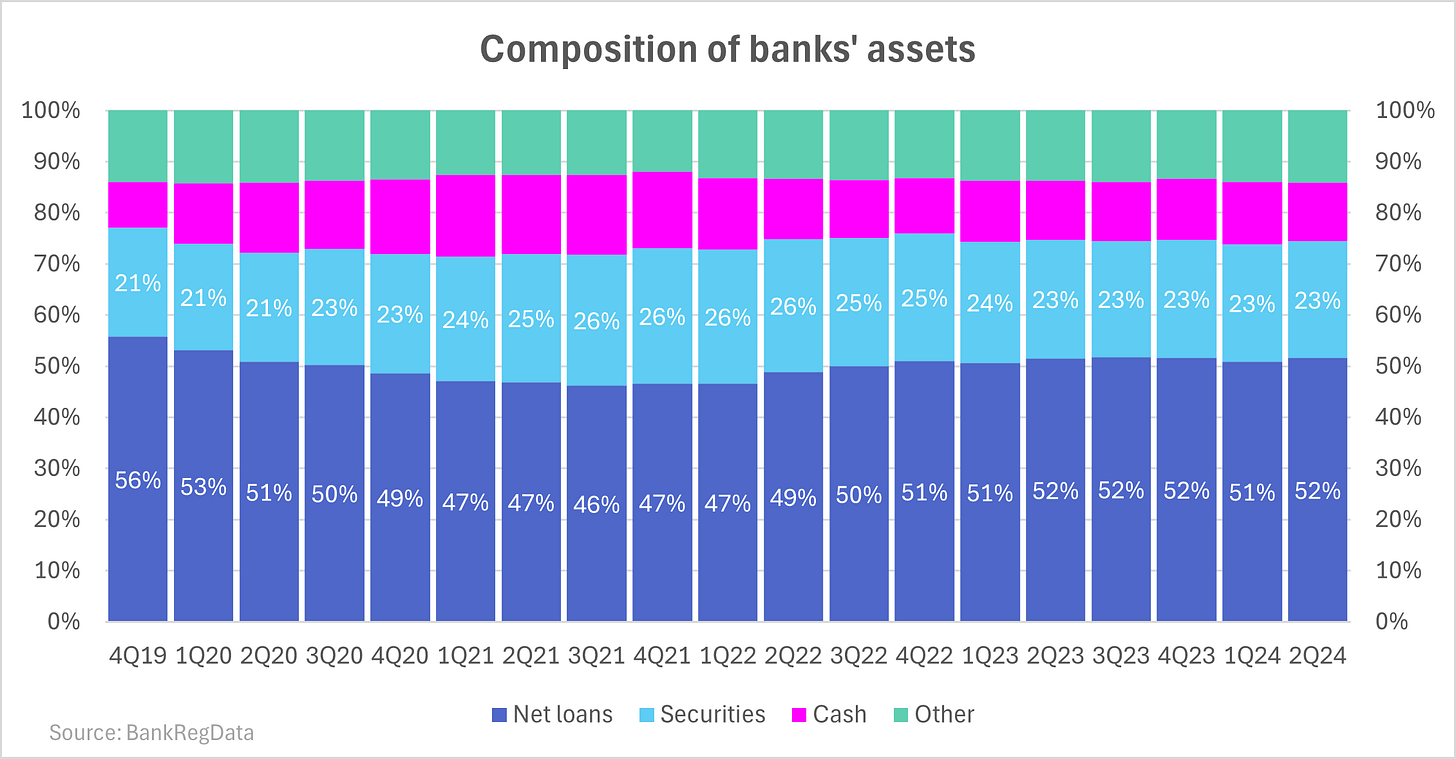

On Sunday, I wrote about the fact that bank lending to households and businesses is effectively no longer growing, and that a disproportionate amount of banks’ loan growth is going to nondepository financial institutions (NDFIs) such as private credit firms, hedge funds and securitization vehicles. It’s impossible to know how much of the lack of loan growth to Main Street (vs. Wall Street) is attributable to unwillingness on the part of households and businesses to borrow more vs. banks’ unwillingness or inability to lend more to them. What’s easier to see is why there are constraints on banks’ asset/loan growth (loans account for just over half of banks’ assets) that didn’t exist pre-pandemic.

Borrowing from Mr. McGuire from The Graduate, I want to say just two words to you. Just two words. Unrealized losses. There’s not a great future in unrealized losses. I previously wrote about banks’ Tier 1 capital, which is the strongest form of bank capital. Since the beginning of 2019, it has grown by 28%. However, after adjusting it for banks’ substantial unrealized losses on their available-for-sale (AFS) and held-to-maturity (HTM) securities, it only grew 6%; as of 2Q, unrealized losses represented nearly 25% of their Tier 1 capital. Banks know they’re sitting on these unrealized losses, and are perhaps acting accordingly by limiting their asset/loan growth. While unrealized losses will have fallen in 3Q when the FDIC’s Quarterly Banking Profile comes out owing to the combination of lower interest rates (which increase the value of bond prices) and the sale of bonds by banks that resulted in realized losses, interest rates have reversed course following the Federal Reserve’s (Fed) decision to cut the federal funds rate by 50 basis points in September, such that the 10-year Treasury yield is essentially unchanged from where it was at the end of 2Q (and the 5-year yield isn’t much lower than where it was).

For some perspective, banks’ Tier 1 leverage ratio (meaning Tier 1 capital as a percentage of average total assets) is around 10x. This means that banks’ assets are about 10 times the size of their equity. After-tax unrealized losses of ~$400 billion (unrealized losses as of 2Q were $512.9 billion) levered 10 times is ~$4 trillion, which equates to ~15% of banks’ total assets. That’s a lot of lending capacity that’s being constrained by banks’ unrealized losses.

How did banks arrive at this point? At the end of 2019, net loans accounted for 56% of their assets, while securities were 21% and cash was 9%. Two years later, securities and cash were up to 26% and 15%, respectively, while loans were down to 47%. Why did this happen? Extraordinary fiscal and monetary stimulus in response to the pandemic left banks with substantial excess deposits and declining loan demand, and many banks opted to purchase fixed-rate, longer-maturity mortgage-backed securities (MBS) and Treasury securities in order to earn a higher yield than holding cash or other short-term instruments; their securities holdings increased by $2 trillion (~50%) from early 2020 to early 2022. In so doing, banks became more sensitive to interest rate changes, and at precisely the wrong time: the Fed embarked on a historic interest rate hiking campaign beginning in March 2022, and banks found themselves sitting on record-high unrealized losses.

It’s not only unrealized losses that are constraining banks’ asset/loan growth; so too may be deteriorating loan quality. Nonperforming loans (and nonperforming loans as a percentage of total loans) have been rising since 2022q3, and per the FDIC’s second-quarter Quarterly Banking Profile, the industry’s net charge-off ratio was highest quarterly rate reported in over a decade (since 2013q2) and provisions for credit losses have been higher than the pre-pandemic average for the past eight quarters (and not just because of loan growth). I’ll write about this topic at greater length after all banks have filed their 3Q call reports.