FDIC's 3Q Quarterly Banking Profile Highlights Banks' Increasing Exposure to NDFIs and Substantial Exposure to Fluctuations in Interest Rates

Loan growth to the real economy remains minimal

The Federal Deposit Insurance Corporation (FDIC) released its 3Q Quarterly Banking Profile (QBP) yesterday. I’ve written several times in recent months about banks’ growing exposure to nondepository financial institutions (NDFIs) such as private credit firms, hedge funds and securitization vehicles (essentially levered investment funds) and high sensitivity to fluctuations in long-term interest rates owing to their sizable securities holdings. The FDIC’s QBP touched on both.

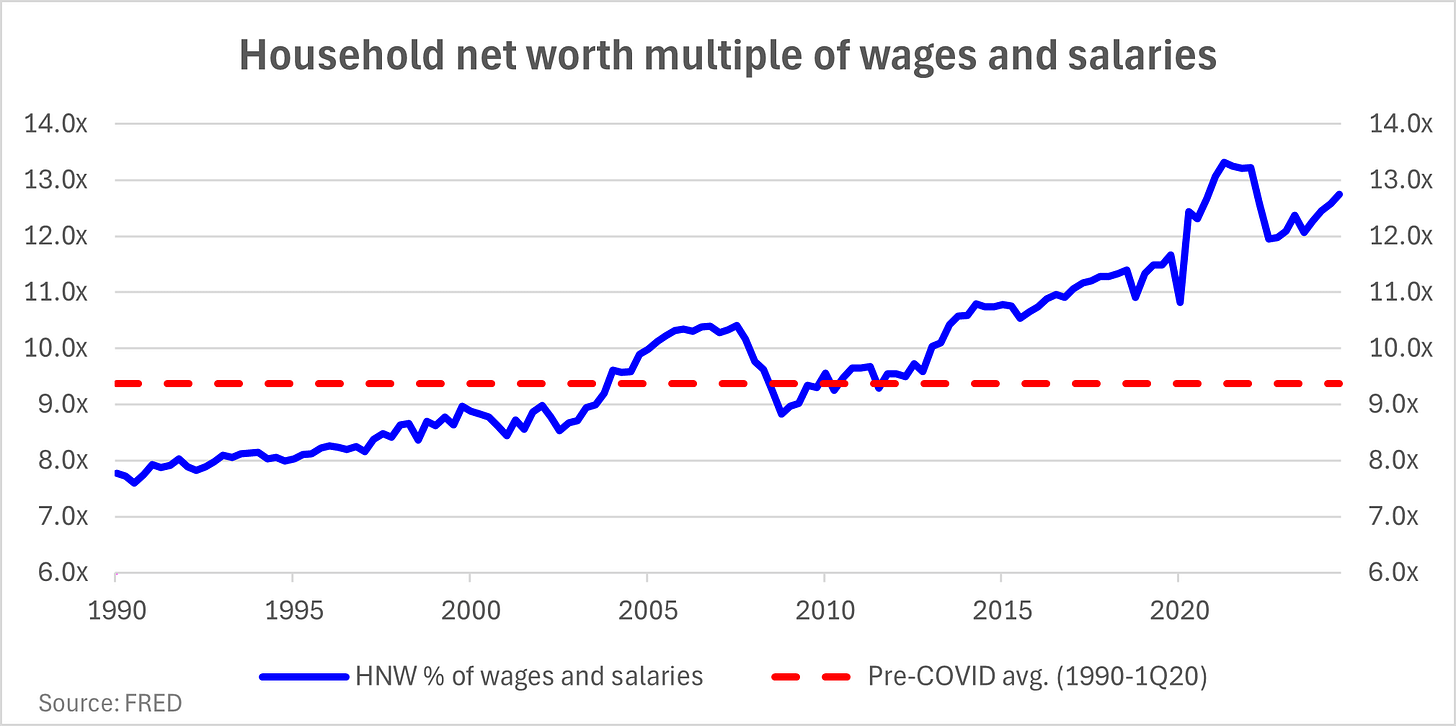

Regarding the former, the FDIC noted that 36% of banks’ loans and leases growth from the previous quarter and 41% from a year ago went to NDFIs, bearing in mind that loans to NDFIs accounted for only 7% of total loans in 3Q. Bank loans to NDFIs were up 14.4% YoY, compared to all other loans up only 1.4% YoY. The growth rate of bank loans to all borrowers other than NDFIs is its lowest in over a decade excluding the pandemic period. Given the disproportionate growth in bank lending to levered investment funds vs. households and businesses, it should come as no surprise that the financial economy (reflected in ever-rising asset prices and record U.S. household net worth) is performing far better than the real one. Along those lines, the ratio of household net worth to wages and salaries rose yet again in 3Q thanks to the latest jump in household net worth (via the Federal Reserve’s Z.1 report released yesterday).

As I’ve written thanks to data that Bill Moreland at BankRegData compiled, the FDIC noted that banks’ unrealized losses on securities decreased by ~$150 billion from 2Q to 3Q owing to lower long-term interest rates (particularly the 30-year mortgage and 10-year Treasury rates). However, the sequential improvement in unrealized losses is likely to prove fleeting owing to the recent increase in long-term rates: the FDIC’s Chair Martin Gruenberg said the rise in long-term rates since the end of 3Q “would likely reverse most of these improvements in unrealized losses if measured today.” Indeed, the 10-year Treasury yield at 4.35% is at the same level it was at the end of 2Q. Why is the issue of unrealized losses so important? As of the end of 2Q, banks’ unrealized losses on securities accounted for nearly 25% of their Tier 1 capital, such that their Tier 1 capital had barely grown from the beginning of 2019 after adjusting for those losses (link).

For some perspective, banks’ Tier 1 leverage ratio (meaning Tier 1 capital as a percentage of average total assets) is around 10x. This means that banks’ assets are about 10 times the size of their equity. After-tax unrealized losses of ~$400 billion (unrealized losses as of 2Q were $512.9 billion) levered 10 times is ~$4 trillion, which equates to ~15% of banks’ total assets. That’s a lot of lending capacity that’s being constrained by banks’ unrealized losses. And what little loan growth is occurring is largely going to NDFIs.